Your first budget does not need to feel daunting. It simply has to work. Your budget is also a living, breathing document – it is meant to change over time.

I’m going to take you through the basics of budgeting on a monthly basis, which in my experience works the best for most people, because you’re billed on a monthly basis.

>>> If you do not have the free budget download, click here to get it <<<

Start with your income

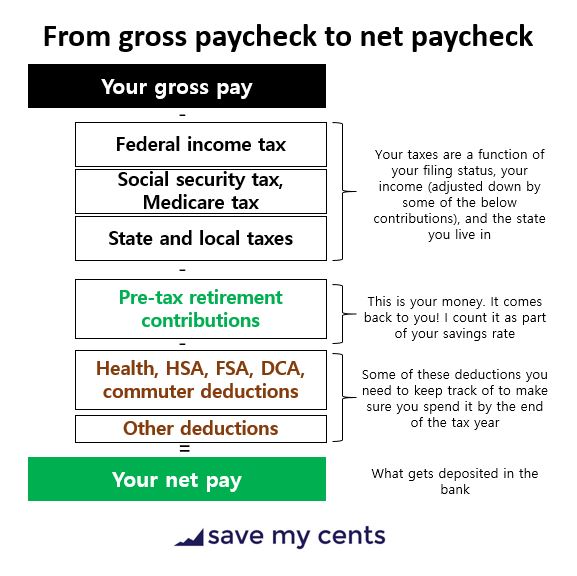

Before we “budget”, we need to understand where the money on our paycheck goes. The following is for U.S. audiences.

I talk a lot in my retirement posts about income tax. The 2 key numbers I want you to remember is how much you’re paid before all the taxes and deductions (gross pay), and what gets deposited in the bank (net pay). If you make pre-tax retirement contributions (such as to a 401(k), 403(b), 457(b), TSP) you will also see this on your paycheck.

Your net pay is what you have available to you to make ends meet

The key is to spend less than you earn. Will you get it perfect? No. We don’t beat ourselves up. The budget worksheet is here for us to learn.

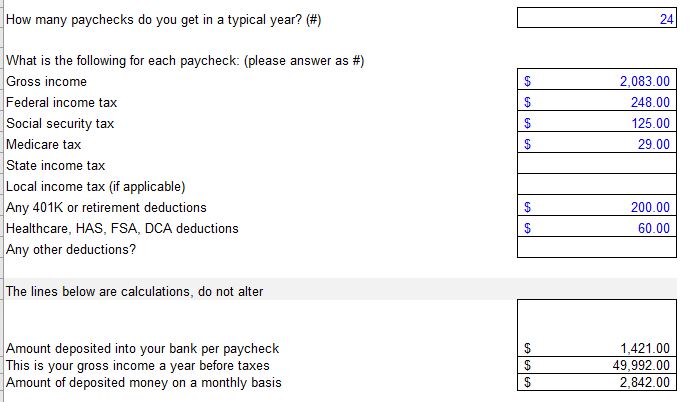

In the worksheet we type in all the information we can off of a typical paycheck, multiply it by the total number of paychecks in a year, divide it by 12, to get to your monthly amount. Here is an example of a person earning about $50,000 a year with 24 paychecks.

Gather all your annual and your monthly bills in one place

Annual bills are tricky because we often forget about them. The below image shows a list of common ones. For now, try to sum up as many as you can remember. Then divide them by 12 and assign them to your budget categories. Another way to do this is using a “sinking fund”, which my workbook gives you a way to calculate.

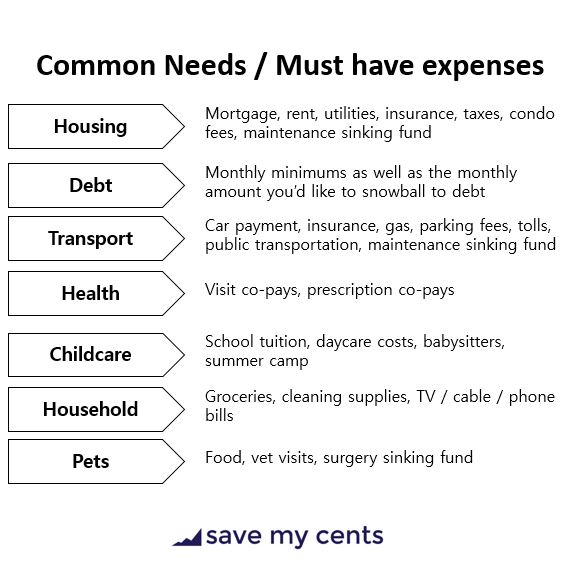

Monthly bills are easier. Take them all and add them to your categories. The graphic below shows common needs / must have expenses. Then you might also have some nice to have expenses of your own.

You cannot spend more than you earn

If after doing this, you are spending more than you earn, you can only really do two things. Reduce your spending, or, earn more money. In the short term, reducing spending is usually easier. In the long term, earning more money is also important. We should aim to do both.

Put in a wealth goal

Before we go to nice to have expenses, I tend to favor in putting in a savings goal. This gets us into the habit of paying ourselves first – either by paying off debt, or saving, or both. This also helps train our mind into seeing growing our net worth as a budget item – something to be planned for. Paying off debt increases your net worth too, by the way, which is why I like to call this a “Wealth” goal.

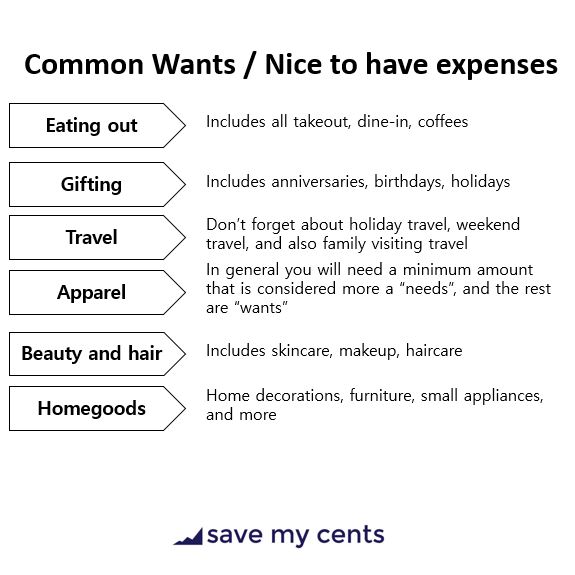

Estimate your wants / nice to have expenses

With the money left, divide it into your nice to have expense categories. Do your best to estimate it in the beginning, then as you track, you will see which ones are realistic, and which ones are not.

Make it a habit to track on a weekly, if not daily basis, for 3 months

In the beginning, I want you to track your expenses almost daily, if not at least weekly. This is because you’re not going to get it perfect, and tracking will help you see where your budget needs tweaking, or more importantly, what expenses you may have forgotten (there will be a lot of these moments!) I created a sheet called “Tracking” that does this for you.

Tracking is writing down your expenses and assigning it to a category. Then, we actively watch the spending in that category to keep it under budget. If you go over budget in a category, the worksheet lights up in bright yellow.

The reason why I want a minimum of 3 months, is because you’re rarely going to get “perfect” budgeting months. Some months you’ll spend more and some months you’ll spend less, especially if you buy in bulk. 3 months is a much better time frame to see how things average out. In the excel I made, there is a way to see things on an annual basis, so you can calculate your spending on average and smooth out the month to month variation.

If you’re interested in getting individual help from Shang, see if coaching might be right for you.