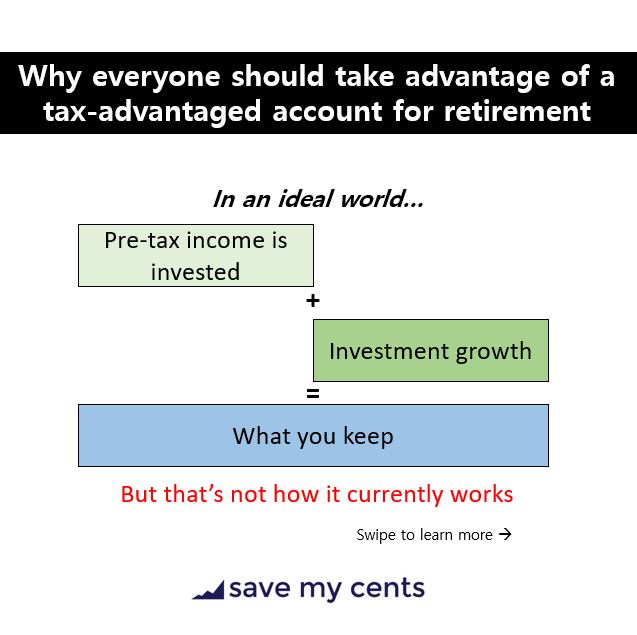

In this ideal world – a world without taxes, we would be able to keep both the money that we invest, and the growth that comes from the investment, forever. In this example, your pre-tax income is all the income you are paid before paying income tax. Investment growth is whatever growth that is realized from your investment, in this example it is buying stocks / bonds / mutual funds / index funds at a lower price and selling at a higher price.

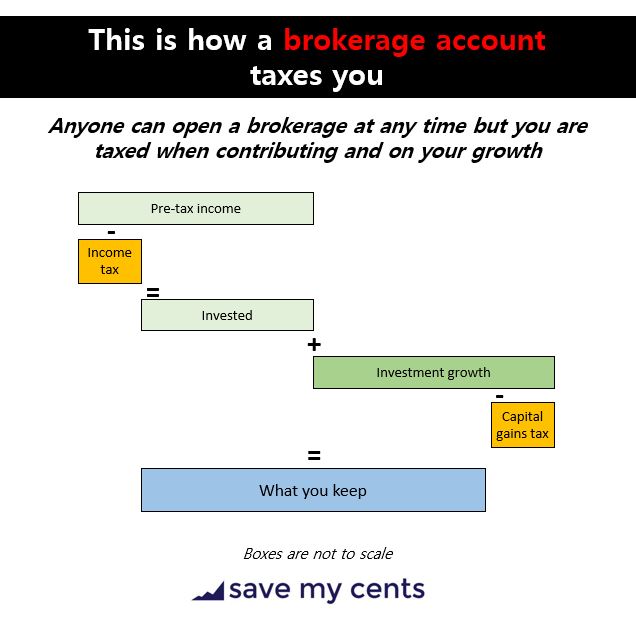

A brokerage account is an account where you can trade investments such as stocks, bonds, mutual funds, and index funds. It also can hold cash for you. Brokerage accounts are also commonly called investing or trading accounts. Anyone in the U.S. age 18 and over can open one with financial institutions that offer them (such as Fidelity)

A brokerage, as I like to say, taxes you twice. The money you contribute to the brokerage is already after tax (you paid income taxes on it). Then, if your investments grow, your investments are taxed once more, by the capital gains tax. While I do invest in a brokerage, it is not my preferred place to go investing for retirement, as I have other choices that have better tax treatment. See the next two images for why.

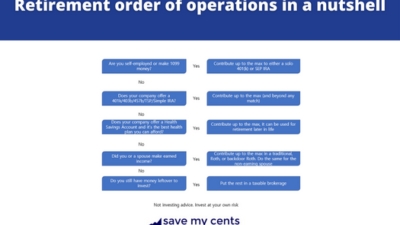

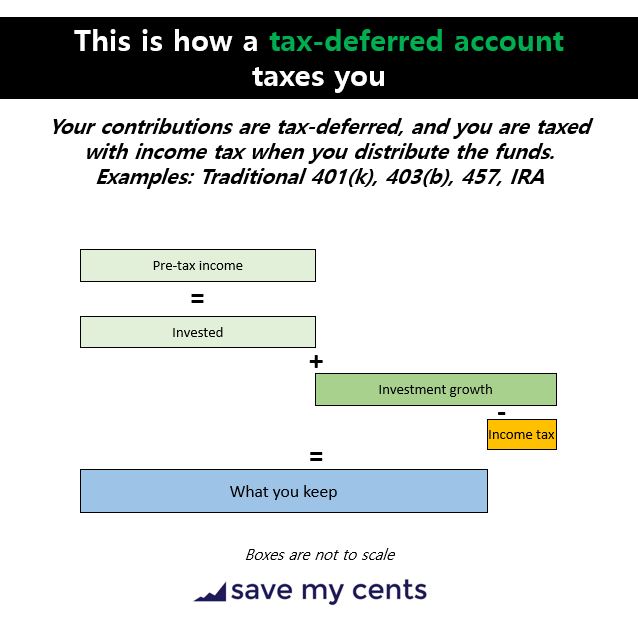

Tax-deferred accounts are some of the most commonly offered tax-advantaged retirement accounts available in the U.S. They include traditional 401(k), 403(b), 457, and IRAs. They are called “tax-deferred” because they defer your income taxes until you withdraw from the account. Thus, your contributions today, is the full amount of pre-tax income that you choose to send to the account.

When you withdraw, typically after age 59.5, you then pay income taxes on the amount that you withdraw. Some people point out that the risk of investing in such an account is that tax rates may rise in the future. I agree that is a risk, but it is a risk that none of us can truly predict so far into the future. Therefore, if I have a choice between this account vs. a brokerage for retirement, I would put money here first.

401(k), 403(b), and 457 are offered by employers. You can open an IRA on your own. If you are self employed, you can open your own solo 401(k) or SEP IRA, or if your company is larger, consider Human Interest to help you open and run a 401(k) for your company.

What if I don’t get a match? That is another common question I get asked. The point here is – not everyone gets a match, contribute anyway. A match is a perk. Just like having access to such an account is a perk. You want to take advantage of it.

A Roth account (Roth 401(k), Roth 403(b), Roth 457, or Roth IRA) is another attractive area to invest for retirement. The reason why many people favor this account is because it frees you from tax worries. The money you contribute right now is after tax (you already paid income taxes on it), and all growth is withdrawn without any income taxes charged when you retire after age 59.5

Your employer may offer Roth versions of 401(k), 403(b), 457, or, you can open a Roth IRA on your own.

If you’re new to investing for retirement, these are three must-read books I think you should read before really diving into it or talking to a financial advisor. I may get a commission if you click on these links to purchase at no cost to you.

Start with this book, because it is written for beginner investors and assumes you don’t have any prior knowledge on investing

This is the most-recommended book I’ve seen when it comes to retirement and I agree. It is well written and well-researched

I prefer having at least one advanced book recommendation and this book does not withhold any punches. It is factual and jumps right in assuming you know what a brokerage does and goes much deeper into discussion investing styles that Bogleheads (those who prefer index funds and follow Jack Bogle’s investing philosophy) favor