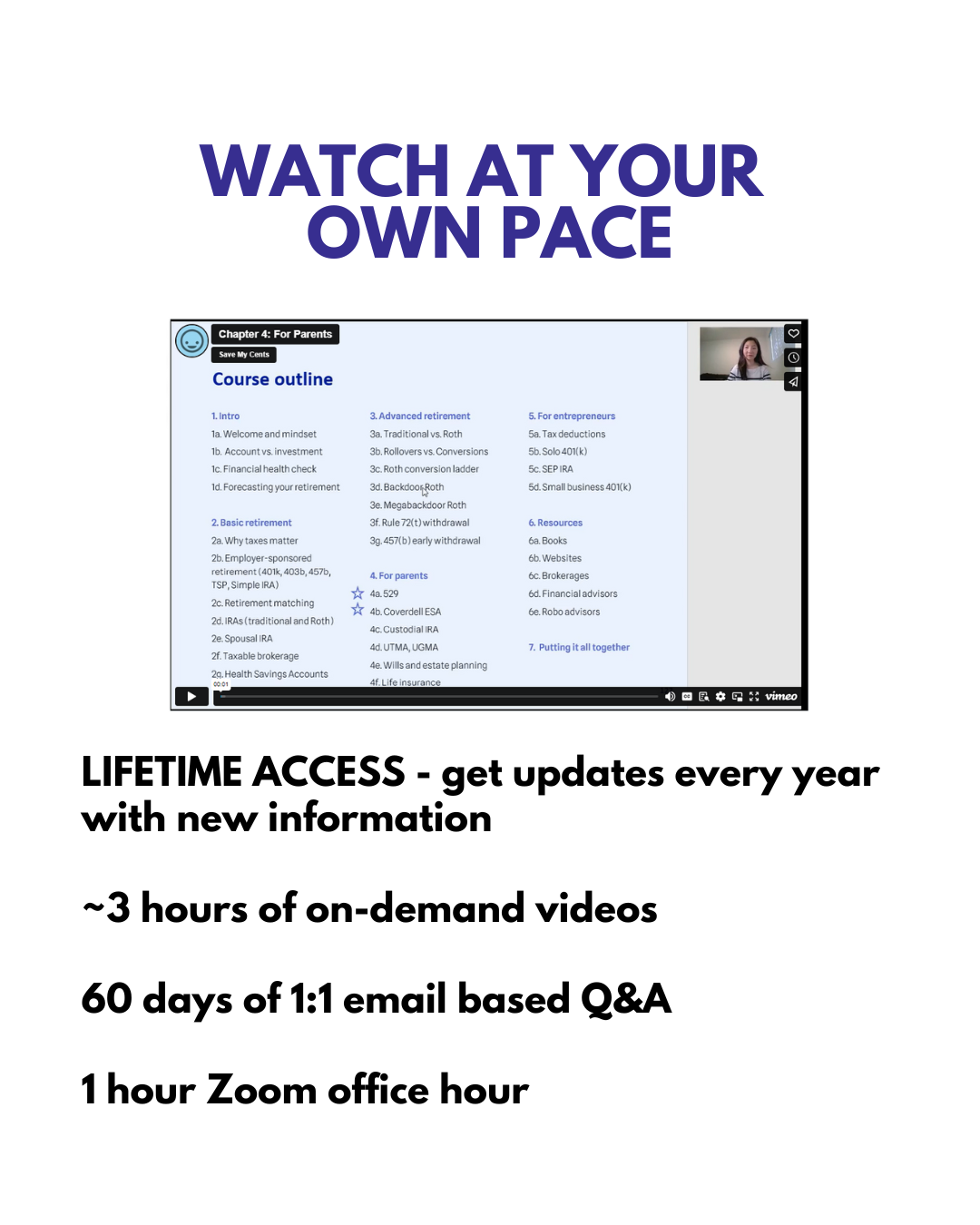

How does the class work?

- Class registration opens few times a year

- The first 60 days you will receive guided emails to make sure you are on-track

- Videos are split into 10 – 20 minute segments for easy watching

- You will be invited to a private Zoom to discuss questions

- The course comes with a 7 day refund policy

Shang has achieved what many aspire to do – the ability to retire early off of investments, in her 30s. Here’s why you should learn from Shang of Save My Cents