Travel is one of the things we love the most. Spending money, is one of the things we love the least. To reconcile these two values, my husband and I spend an enormous amount of time “travel hacking”. This means staying on top of travel credit card sign-ups with large bonuses by reading blogs, achieving said bonuses with our tithing and donation spend (we typically don’t spend as much as the credit card sign-ups require, but we donate 10% of our gross income each year, which is significant), and keeping track with spreadsheets, and calling / writing customer service to make sure that things pan out.

This year our goals are such:

- Spend no more than $5,000 in cash on travel (this is for 2 of us)

- Visit London, Hawaii, Alaska, for our vacations

- See our families in Indiana and California for the winter holidays

- Attend a few weddings

Travel hacking benefits / goals unlocked recently:

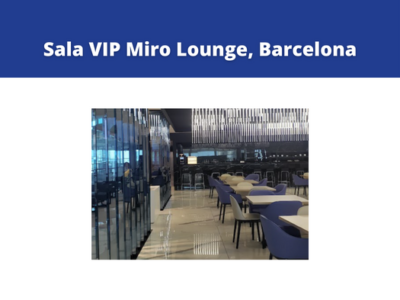

- 100K points at sign-up, ~25-50K points annually: With my Chase Sapphire Reserve card. This is my main credit card. I earn more points on travel and eating out (3x points). I receive airport lounge access via Priority Pass which helps me never pay for food when transferring through airports. There are myriad other benefits including Global Entry / TSA Pre and primary rental car insurance coverage

- Both my husband and I still have airline points remaining with United, British Airways (which we can use to book American Airlines flights)

- My greatest loyalty is to Starwood Preferred Guest. I participated in the SPG 2018 Status Challenge and achieved Platinum. This gives me suite upgrades, 3x starpoints per stay, and lounge / food access in certain hotels. I registered for their “SPG Great Weeks, Great Weekends” which multiplied my starpoint earn on my trip. From one 3-week work trip I earned 13,000 points, which was enough to book a free night for my friend Carmen on her dream trip to Japan

- As part of reaching Platinum status, I could also link it to other statuses across the system using Crossover Rewards. Despite flying very infrequently, I now have Delta Silver status, Marriott Platinum, United Silver Status, and Hertz Five Star status

- 25K + 35K points at sign-up, ~5-10K points annually: I have both the SPG American Express and the SPG Business American Express card. These cards give me a boost each of 2 stays and 5 nights credit per year, and 2x starpoints on spend at hotels. I use this card to tithe when we don’t have other credit card sign-ups, and when I stay in SPG hotels

- 80K points at sign-up – IHG credit card – this card has a reasonable annual fee of $49, and comes with a free anniversary night. The points aren’t much to write home about, but the free anniversary night can be used on Kimpton and Intercontinental hotels – which often start at $300 a night. It’s a great way to get a luxury hotel night for a reasonable price

- ~10K points remaining – I had the Barclaycard Arrival + which was really helpful in 2016 and 2017 when we made a lot of trips where we mostly stayed in lodges, inns, and no-brand hotels. The points on this card convert to travel credits. They’ve made it a bit harder to use now (it used to be any denomination above $100, now it has to be increments) so I stopped using this card

- Alaska Airlines credit card – my husband signed up for this in anticipation of our Alaska trip, it comes with a Companion Pass

- National Car Emerald Club – This is a free sign-up and gets you additional driver fees waived. Chase has booking discounts with National, so it helps us save money on drive-heavy trips

- 2 free nights – Wyndham Rewards. We stayed in a bunch of Super 8 when we went to Yellowstone / Montana last year and using a promotion, earned 2 free nights

Accomplished so far:

London / Berlin / Munich, ~$500 in spend

This was the surprise / opportunity of a lifetime. I had mentioned early after the new year how much I’d love to see London, but figured it would happen in 2019 or later. Then suddenly I was offered a rare opportunity to work abroad for my company, which allowed me and my husband to visit Europe together.

- Airfare – Most was comped, but we also spent ~$140 to get me moving around Europe

- Lodging- Stayed with friend in Berlin, used Accor points for Novotel in London, and some ~$20 in taxes

- Transportation – ~$200 – this is an over-estimate, on trains (one being the Munich to Berlin train), a special tourist pass in Munich, and local public transportation

- Food – ~$140

Hawaii, 10 days – ~$1,200 in spend

- We used massive amount of travel points to book this amazing trip

Alaska, 8 days – ~$2,000-$2,500 estimated

- I am currently planning this trip

- Airfare – ~$900 with the use of the Companion Fare

- Lodging: ~$550. We used Wyndham Rewards to redeem for 2 free nights. The hotel cost is helped somewhat as we are bringing hubby’s parents along, and can find 4-occupancy cabins and B&Bs that are not double the price

- Car – to be booked with Chase points

- Food – ~$400, hope to save some by having kitchenettes a few nights so we could cook groceries

- Tours – ~$600. Alaska is the land of expensive but impressive tours, and this is where we are splurging. We were able to book one of the most expensive tours using Chase points

- Gas – ~$100

- Cash / points reimbursement – ~$500 – We are getting some cash back from the in-laws for booking a bunch of things for free

Winter holidays – ~$200-400 estimated

- Airfare – Booked with Chase points and other available airline points

- Lodging – Our parents will be hosting us

- Car – We borrow from parents

- Food – ~$200-400 – this is when we pig out and also treat others

California wedding – ~$100 estimated

- Airfare – Booked with 25K United miles

- Lodging – Free, covered by bride & groom

- Car – Booked with 6.5K chase points

- Food & gas – ~$100 estimate

Seattle wedding ~$100 estimated

- Airfare – 20K Chase points

- Lodging – Free, being hosted by a friend

- Car – to be booked w/Chase points

- Food & gas – $100 estimate

Follow me on instagram @savemycents