Shang’s note: Today’s travel hacking post is written by none other than my fabulous assistant, Megan Nolan! Megan helps break down some of the most common types of credit cards for travel hacking and the pros and cons of each.

Which credit card is better when it comes to travel hacking?

Choosing the right card for travel hacking all depends on your lifestyle. Earning rewards is one of the biggest perks of using a credit card, but it can also be confusing to navigate the different offers. They each have advantages. This post is meant to summarize the most basic pros and cons of each card. I highly recommend that you check out blogs like The Points Guy for in-depth research.

I’m going to explain three main kinds of cards: Cash-back, general points-based cards, and co-branded cards.

Cash-back credit cards offer a percentage of cash back for each dollar you spend. These cards are low-maintenance and don’t require a lot of effort to collect and redeem rewards. Many of them have very low or no annual fees, making these cards a great way to get introduced to credit card rewards. Most of these cards offer a flat rate percentage for cash back. For example, you could get a minimum 2% cash back on all purchases, 3% cash back when used on groceries and gas, and then a bonus 5% on special categories or rotating categories throughout a year. This is a great option for a beginner reward credit card; however, sign-up bonuses tend to be modest.

Points-based cards are bank-branded cards (e.g., branded with JP Morgan Chase, or Bank of America) with rewards that can cover a range of travel expenses. Typically, these cards offer rewards in the form of points, which you can redeem using the card’s portal directly to pay for travel expenses, or, you could transfer them to an available loyalty program that accepts these points (e.g., American Airlines AAdvantage, to then redeem for travel expenses in that loyalty program) An example is the Chase Sapphire Preferred credit card, which contains the top credit cards that the Save My Cents have used to travel hack. Some of these cards can reach significant annual fees in the hundreds of dollars, so you need to do the math to make sure it works for you.

Co-branded cards are usually credit cards associated with an airline or hotel loyalty program. You would earn either points or miles when spending on this credit card, and you can typically redeem the points / miles with that co-branded loyalty program. Additional points multipliers (where you get extra points / miles) are typically available when you use that card to pay directly for that airline / hotel, which can stack up over time if you’re very loyal. Annual fees typically start at around $95 and go up from there.

Points-based and co-branded cards give cardholders more redemption options than cash-back cards, but typically require you to put in some effort to find the best deal. If travel redemption does not seem important to you, you could also spend the points or miles on gift cards, merchandise and statement credits, though in general, the travel hacking industry has calculated these redemptions to be not a good use of the points you’ve accumulated.

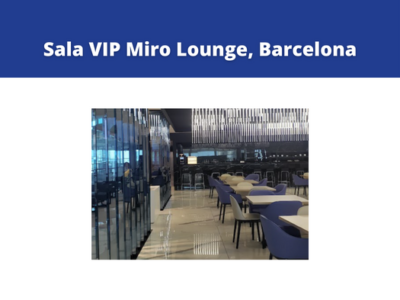

Other special perks – many of these travel hacking focused credit cards come with perks that can help make the higher annual fees worth it. Some include airport lounge access (typically through Priority Pass, though American Express has built their own chain of Centurion lounges), a credit for Global Entry or TSA Pre-check membership, travel insurance, free priority memberships with delivery apps, and more. Keep in mind that the more perks a card offers, the higher the annual fees typically.

To really make travel hacking worth it, you will need to do some research and read the fine print. Always read the fine print before applying for a credit card to make sure you understand the rewards you can receive and how to maximize the benefits. Ultimately, the right type of rewards card for you depends on your spending habits, budget, and preferences.

The mission of Save My Cents is to help people with their money one cent at a time, and credit card rewards can be one way to help with this. To learn more, follow me at @savemycents on Instagram and @savemycentsfb on Facebook.