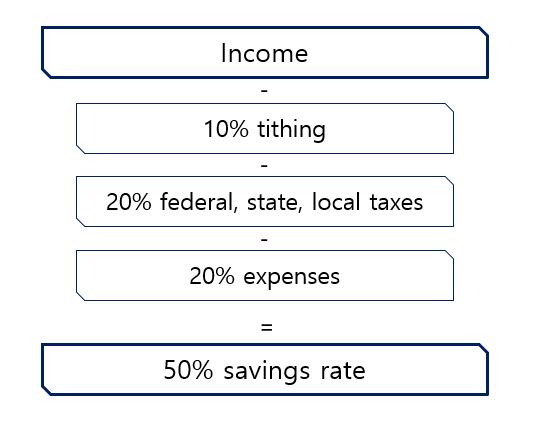

My husband and I typically calculate a savings rate for an entire year towards the end of December. This savings rate is what we report publicly. As I may have mentioned before, when I was single, my savings rate hovered in the 30-40% range, and went up to 50% during the most intense years leading up to us hitting our FI/RE work optional net worth goal.

Savings = anything not sent to taxes, giving, or expenses in a given time period

This picture represents how a typical year in our years leading up to FI/RE might look like

For us, tithing was a religious priority and came off of our pre-tax income. This was our choice and is not necessarily something I push on other people, but I’m putting it up there so you can see how important that component is to us. And since we were able to deduct so much from our giving, this helped keep our taxes (at that time) all-in closer to 20% (right now it’s 25% since the tax reform of 2018 has taken place).

I recommend dividing it by your pre-tax income to allow for apples to apples comparison

Remember how in my blog about your first budget I ask that you start with your gross pre-tax income?

One, because taxes vary all over the U.S., dividing your savings by your pre-tax income makes it easier for you to compare to others, without adjusting up or down for taxes.

Two, this is technically the textbook definition of how savings rate is defined.

Three, this also accounts for pre-tax savings such as contributions to your work-sponsored retirement plan like a 401(k)!

What is included in our savings in a typical year?

Contributions to retirement plan, which includes 401(k) and IRA

Contributions to education savings plans, such as the 529

Contributions to a brokerage

Paying down the principal portion of our home mortgage

Cash savings that do not get spent by the end of the year (to clarify, if you have annual sinking funds that get depleted within the year, I do not count that as part of your annual savings rate, because you end up spending it)

How do I calculate savings rate if I am in debt?

For most consumer debt, I don’t count money you sent to the principal, as part of your savings. This is typically because unlike a home, you do not have an underlying asset that supports the debt, that is also holding its value over time (cars, electronics, depreciate in value over time, and you consume services and other goods that you’ve put on a credit card, and there is no collateral for a student loan). Therefore, if you are in debt repayment mode, it can feel frustrating to have what seems like a very low savings rate.

But, hang in there! The moment you pay off your debt, all that money you had been using to send to minimum payments and extra payments, now can becomes savings, you don’t spend it. And for many people, this means that you automatically jump up to an incredibly high savings rate. Don’t waste this opportunity and get started on building your net worth right away. I see a lot of people losing momentum the moment they pay off debt. Treat the money you’d been sending to debt like another budget item – except now it goes towards savings and retirement. That will help keep the momentum going, and build your net worth.