I’d often seen on charity donation pages the ability to donate stock, and it never hit me why this was something that people did. Well NOW I KNOW!

Suppose you are a person who gives $10,000 each year to charities. If you gift cash, that is $10,000 of your post-tax earnings to various charities that are 501(c)(3) organizations. This means that these donations are tax deductible, assuming you don’t take the standard tax deduction each year (which has increased to $24,000 recently, so it actually is a higher hurdle for people who previously benefited from the lower $10,000 standard deduction).

The organizations would send back a donation receipt acknowledgement that lists how much of the donation can be deducted from taxes. If for example you bought tickets to a gala or there was a product that came with your donation, the charities have to deduct the fair market value of that purchase. However, the United States tax laws currently also allow you to donate appreciated investments instead. There are two main advantages of it.

Advantage #1: You “saved” because your investments grew, so you’re donating a smaller original base

Let’s say that a few years ago, you invested $5,000 into an index fund called “U.S. Stock Market Index Fund”, and it has grown to $10,000 today. You can donate / gift that appreciated (appreciated = it grew in value).

So while you’re technically gifting $10,000 of wealth, that came from a $5,000 original base. So instead of the $10,000 in cash you would have given away this year, you can take that $10,000 in cash, and keep investing it and hoping it would grow in the future.

Advantage #2: You save on capital gains tax of 15-20%

Under normal circumstances, if you sold your $10,000 stake in the U.S. Stock Market Index Fund, you’d realize capital gains (growth in investments) of $5,000 that year. The IRS would like a piece of that. Depending on your tax bracket and also how long you have held on to the investment, they might tax 15-20% of those gains, meaning right off the bat you could give up to $1,000 to the IRS and never see it!

If you donate all $10,000 of that, the IRS does not charge you capital gains tax on those donations, and the charity gets to keep all $10,000. Win win.

How to donate

Based on Mr. Savemycents and my calculations, we stand to gain about $14-15K in savings across the two advantages above for our gifting this year, so it was definitely worth the time invested to do it. We also hope to look into Donor Advised Funds in the future, based on the feedback I received from some even savvier friends.

- Figure out what YOUR investment firm needs in order for you to donate. My investment fund is with Fidelity, and they laid out their requirements quite clearly on this page after I was directed to it by calling into customer service. Most charities have their own investment accounts, so I was following the instructions for “Gifts sent to an outside brokerage account”

- Gather the information. I navigated to the “how to gift” pages for all our charities, but oftentimes the information was incomplete. So I emailed or used the online forms to get someone at the charity who would answer the information

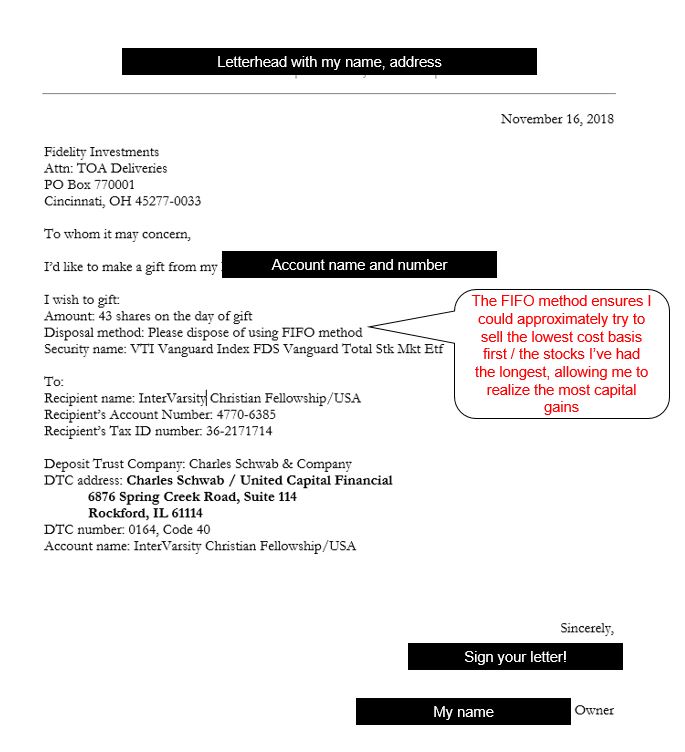

- Write the letter(s) of instruction, and triple check them. Any typo or lack of clarity around the instruction could result in bad execution. For example, I forgot to sign one of my letters.

Here is an example of one of my letters.

4. I dropped the letters off at the nearest Fidelity customer service center. That is one thing I really do like about Fidelity is how they have physical branches. For example, I found out that I did not need to get a Medallion Signature Guarantee on my letters – they’d do that internally and take care of it for me. And they were the ones to point out I forgot to sign my letters.

5. The stock trade does not happen right away. It might take a few business days for this to go through, so ideally you want to do it when the markets are not very tumultuous (although no one can truly predict that).

6. Then, follow up with each of the charities. They don’t know who donates stocks when it comes in. You have to write them an email that states your name, contact information, and the fund name & number of shares that you’d donated, in order for them to successfully write you a donor letter, which is what you need for tax filing purposes. In the email, also specify how you’d like the gift to be used. For example, my donation to InterVarsity above is actually being split among 5 teams who work for that non-profit, so I’m going to have to be very specific.

There is a limit: 30% of your AGI – lower than 60% of AGI for donations in cash

This article from Charles Schwab does a good job of explaining various ways you can donate and receive tax advantages for each, and notes that using this method, the only disadvantage against cash is that you can’t just give away so much and get away with paying no taxes at all for the year. The limit in any given year is 30% of AGI.

Get the most out of Save My Cents by joining the wait list for my Save My Retirement Masterclass

See daily inspiration on Instagram @savemycents