This is a very common source of confusion for many people who ask me questions, it starts out like this:

“Shang, I don’t know what I want to invest in” – online person

“Okay, well, I’m not a financial advisor, but what do you think about your options? How do they stack up against your investment horizon and risk tolerance? – me

“Well, I could invest in a 401(k) or an IRA…” – online person

And that’s when I realized the question was not an investing question. It was a retirement account type question. What do I mean by that?

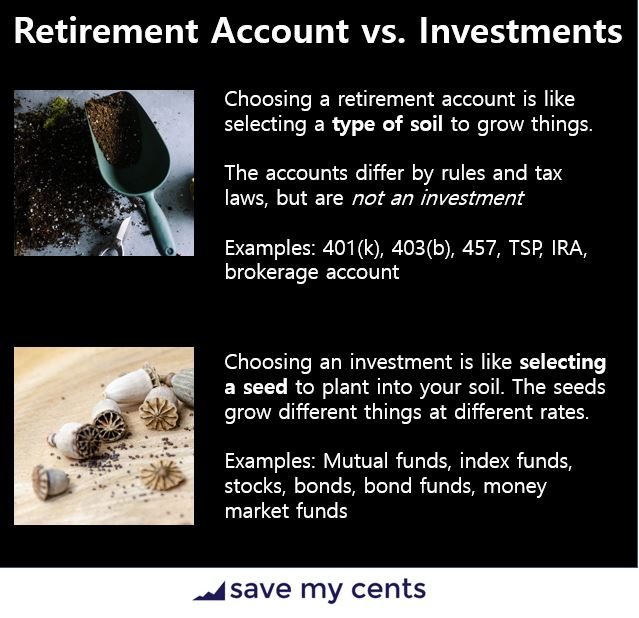

It’s an account, not an investment

Think of your bank account. You don’t typically call your bank account cash. You have an account. And cash sits in it. Retirement accounts are just like that as well. They are like bank accounts, just with more rules and complexity thanks to a very complex tax code in the United States. When you first contribute money to your retirement accounts (such as a 401(k), 403(b), IRA, Roth IRA, or a brokerage), your money sits as cash. Sometimes it’s labeled as a “money market fund” or “government money market” or “core position” or “deposit sweep” (there are a lot of names for cash), but it’s cash. And it grows with barely any interest. You have to invest it.

The investments available to you differ by account type

If you are investing through an employer sponsored plan, whoever your employer contracted to hold your plan (could be a company like Fidelity, Charles Schwab, or a smaller asset management company), they provide some options. And depending on the laws regarding your plan, your options may be limited. Nevertheless, the options available to you are the investments. Examples include annuities, stocks, mutual funds, index funds, target date funds, bonds, bond funds. These are investments.

Okay, so it’s really confusing… who can help me with all of this?

In the U.S., only certified financial planners (you can verify here) can help create an individualized plan for you. However, you pay for that service. Either you do it upfront through fees, or, many of them might recommend you investments that give them commissions or kickbacks over time. Also, not all CFPs are fiduciary – meaning that they invest in your best interest. Many CFPs can recommend investments that certainly make you money, but make them even more, than another investment that could be lower-cost! For this reason alone, people such as Warren Buffett (source: New York Times) and Jack Bogle (the very reason why he founded Vanguard), some of the greatest investors of all time, have warned against paying high fees to investing professionals.

Where can I find low cost help?

The good news is that over the last decade, changes in fintech have led to a new class of advisors – robo advisors. They’re not actually robots. They are typically software algorithms that were created by human advisors to generate investment recommendations based on the investor’s input (such as you telling them a bit more about yourself and what you are looking for in terms of investments). They take the human emotion out of investing on both sides of the table – both yours and the advisor’s. And since it’s software, they’re lower cost than human advisors.

Some well known robo advisors out there include Vanguard Digital Advisor, Fidelity Go, Wealthfront, and Betterment. At this time of writing, the annual fees range from 0.15% (Vanguard) to 0.40% (Fidelity Go), though your own specific fee may vary based on how much you invest through these services.

I blog daily on Instagram @savemycents

If you are new to personal finance, I recommend the free download contained in this beginner budgeting post.

If you are looking to understand the U.S. retirement system in 2 hours or less and de-mystify where you can be investing for your retirement, join my mailing list to nab a spot in my Save My Retirement! Masterclass. Masterclass is released via the mailing list first, and then via my website / Instagram.