In the United States, around 20% of the workforce are considered public sector employees, either employed by the local, state, or federal government. One of the many perks of being a public sector employee is the potential to qualify for and retire on a public pension. Pensions are defined benefit plans, where, based on some formula that typically includes years of service with the employer and the salary towards the end of an employee’s term, the employee is then given a set amount of money each year upon retirement, until death. The reason it is called defined benefit, is because the benefit is typically a fixed amount, such as $X a year, also known as an annuity payment. On the other hand, plans where the employees contribute their own amounts, such as 401(k), 403(b), 457, are called defined contribution plans, because the government sets the amount that one can contribute at any given time.

Most public sector employees have very little control over how the pensions are invested. That is because the pensions are often managed by pension fund managers. Pension fund managers are typically investment managers that were hired by the public sector to administer, manage, invest, and distribute the vast amounts of money that sits in public pensions, since this is not the primary expertise of most of the public sector itself. For example, you can view who are the senior leaders of CalPERS, one of the largest state pension funds in the country, by clicking here. The pension fund managers take on the primary responsibility for the risk of the fund, which is different from a defined contribution plan, where the employee themselves has to decide what to invest in and how to manage it over time.

Today, I’m so excited to team up with Tay from @taysjourneytofi to bring you an up close and personal view of how one bright public employee (Tay) thinks about her pension, as part of her overall retirement plan, and what you can learn from her. I want to emphasize that this blog post only focuses on public pensions and not private pensions. This is because private pensions have been steadily declining and are in the minority. The decline has been driven by the shift towards defined contribution plans (such as 401(k)s), tax reforms, and shortened average length of tenure for private sector employees at any given job, leading to greater demand for portable retirement plans. It is for these reasons that for the majority of people I coach who may have access to private pensions, I generally advise that they should not count on it early in their careers.

Disclaimer: The majority of this blog post is written from Tay’s personal perspective of her pension plan with CalPERS. Every pension plan has different rules, benefits, and requirements. You should verify with your employer about the specifics of your pension plan. Even if you have CalPERS, your specific numbers may still differ from Tay’s due to your employer’s contract.

So Tay, how do pensions typically work?

I have worked in the public sector in California for about 5 years now. My employer contracts with California Public Employees’ Retirement System (CalPERS) for my pension plan. It takes five years for me to become vested and be able to draw a pension from CalPERS – if I had left my job before five years and did not accumulate more service credit in the future, I would not have any benefit upon retirement. The number of years to get vested can vary by employer and plan. Pension plans may offer reciprocity, which allows an employee to work for another public retirement system without losing their benefits provided there is an agreement between the two retirement systems for reciprocity.

Employee and Employer Contribution

There are typically an employee and employer contributions that go towards funding the pension. In California, the employee contribution could vary by employer and plan. I am required to contribute approximately 9% of my pre-tax income into CalPERS and my employer contributes an amount that is equal to approximately 24% of my pre-tax income. My contribution percentage can change at any time during my employment and is negotiated between my union and employer. My contribution earns interest in my pension account, based on how the fund managers invest the contribution. However, I cannot see my employer contribution when I log into my account, and it is not mine to keep, unlike a defined contribution plan such as a 401(k).

Retirement Formula

The defined benefit that I receive from my CalPERS pension is calculated using three factors: service credit, benefit factor, and final compensation (see formula below). My individual contribution is not factored into the simple formula, as CalPERS takes on the risk and responsibility of managing the fund such that the fund can meet the retirement obligations that it has promised.

Service Credit (years) x Benefit Factor (% per year, age) x Final Compensation ($) = Pension/Unmodified Allowance.

- Service Credit / Years of Service (years) – number of service years I have accrued by working for this employer

- Benefit Factor / Pension Multiplier (% per year, age) – A percentage %, differs by age at which I decide to retire – typically the factor is higher as the age of retirement increases.. There is a chart in my membership handbook to look up this %

- High-3 Salary / Final Compensation ($) – highest average annual compensation during any consecutive 36-month period of employment (for many people, tend to be their final three years prior to retirement).

[Source for formula: click here. Sample benefit factor table: page 30 of this source]

Sample Retirement Calculation

You will need to know your benefit factor at a certain age; so reach out to your Human Resources department for this information.

Example 1: I decide to retire in 30 years

Let’s say in 30 years, I’ll be 62. The benefit factor, according to my plan, for age 62, is 2%. If I began working today for the employer, I’d have 30 years of service by the time I’m 62. Let’s also assume that my highest average compensation over a 36-month period is $100,000/year,

My pension benefit is: 30 years x 2% x $100,000/year = $60,000/year

Example 1: I decide to retire in 20 years

Let’s look at another example, and let’s say that I want to retire earlier. The earliest retirement age that my pension plan allows is 52 years old with a benefit factor of 1%. So hypothetically by that time I’d have 20 years of service. Let’s also say that because I’m retiring earlier, my highest average compensation may not be as much, so let’s call it $80,000/year

My pension benefit is: 20 years x 1% x $80,000/year = $16,000/year

It is important to note that the above formula is a simple calculation and more goes into it. The actual pension computation depends on numerous other factors such as how many beneficiaries I want to include, the age of my beneficiary, how much I want to leave to my beneficiary, etc. If you have CalPERS, you can create an online account and there is a calculator to estimate the pension.

How should one account for a pension as part of one’s overall retirement strategy?

Tay:

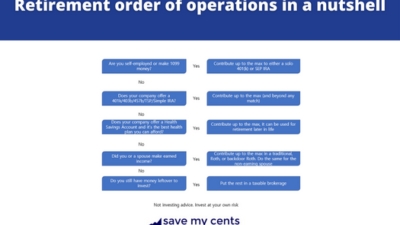

Pension plans may not pay for all of your retirement needs. It is necessary to also save and invest separately as well. I recommend that when you receive a raise and/or cost-of-living adjustment, apply some or all into your other defined contribution accounts such as 457, 401(k), 403(b), or even your own IRA (traditional or Roth). This way you do not feel the pain of having to drastically reduce your spending if you end up not receiving the pension, or if the pension is not adequate to meet your retirement needs. As with all investments, pension plans are not guaranteed to be either secure or safe places to invest. I like to think of a pension as gravy on top. It will not be my main source of income in retirement.

Shang:

If you are just getting started in your career, you know very little about whether you will like this career, employer, or job. You don’t have many years of service, and you also don’t know if your next job would remain in the public sector and would even have a reciprocity agreement. All too often, when I am coaching people in their 30s and 40s, I have seen them change jobs multiple times and have multiple abandoned defined benefit pension plans from which they will never benefit, and thus I cannot count those plans towards their net worth.

For all these reasons, in the beginning years of your career, I pretend the pension does not exist, and you should be saving and investing heavily as if you did not have the pension. This does include investing into the 403(b) and 457(b) and TSP plans if offered, as these are portable, and so even if you leave the job with the pension, the investments in these plans stay with you, and you can roll to your next employer or roll to an IRA.

However, with time comes wisdom. Let’s say you are sticking it through with this career… you typically will know better as you get older. I recommend that every 5 years or so, revisit how much you wish to stay in this sector, this job. As you gain more years of credit, and if you feel that realistically you could look at a pension, then you can start factoring in the pension into your retirement plans. In my private coaching, I do what is called a risk-adjusted pension – I take your pension calculation and then I assign a risk factor to it that accounts for the likelihood of you actually receiving the pension, and then we plan off of that amount.

I also cannot emphasize enough that because each pension contract differs, you must know your rules. As Tay mentioned towards the end, the beneficiary election can have a significant impact on your benefit amount. Some pensions don’t pass to spouses upon death. Your pension can have a significant impact on your quality of life as you retire, so you must know its rules, and take the time now to research it so that you can plan your steps going forward.

If you have never explored your pension before, here are 10 questions you should consider asking

- How is my pension calculated? What is the formula?

- How much do I have to contribute?

- How long does it take to become vested? What does vested mean?

- What happens if I leave my employer before I am vested?

- What happens if I leave my employer after I am vested?

- When is the earliest date I can retire to receive a pension?

- How does my pension address inflation?

- Is there a Purchasing Power Protection Allowance?

- Are there cost-of-living adjustments?

- What happens to my pension upon death? Can it be passed on?

CalPERS’ Sources:

- Watch videos here about the Retirement Benefits

- Click here to learn how CalPERS retirement is calculated

- How Service Credit is accumulated? Click here to learn more

- What happens when you leave CalPERS? Click here for information about Refunds & Reciprocity

Taysjourneytofi is a Single Income, No Kids (SINK) living in California. She documents her journey towards FI/RE on Instagram @taysjourneytofi

Shang is currently wrapping up her one year maternity leave, which was made possible by her reaching FI/RE early on in her career. She teaches the mindsets and frameworks to FI/RE in the course Five Weeks to Abundance, and blogs about retirement on Instagram @savemycents

As someone with CalPERS (fist bump Tay) and knowing most of this information, it was still really helpful having this in one place!

Thank you for sharing this! My husband has NDPers and I have had a difficult time finding much information on how exactly pensions work. It seems they are becoming less popular. This was helpful!