Did you leave a job recently? Now’s a great time to take a look at what to do with your retirement funds.

If your prior employer offered a retirement account such as a 401(k), 403(b), 457(b), or TSP (Thrift Savings Plan), these are all fantastic tools for building a tax-advantaged retirement. Many people panic once they leave their jobs, but in reality, you have a number of great options, and you do not need to make a decision right away

Don’t rush the decision

It will take some time to review your options. You might want to leave the account where it is instead of immediately rolling it into a new IRA or another employer plan.

With the exception of non-government 457(b) accounts, most of these retirement accounts are held in trust, separate from your former employer. All of your contributions, vested matching and profit share, and growth, are yours, even if you’ve left your position (whether voluntary or involuntary). In the case of bankruptcy, your brokerage will contact you for procedures on moving the money into a new account, but it does not affect the value.

What do I mean by vested? In some cases, there is a vesting schedule on employer match / profit sharing. For example, the employer might give you a few years before all of your matches are yours, such as a vesting schedule below

- After 1 year of employment you are 20% vested

- After 2 years of employment you are 40% vested

- After 3 years of employment you are 100% vested

If you leave your job without being 100% vested you will forfeit the unvested portion. Again, you always own your contributions from your paycheck.

Let’s take a look at four options you have, and the pros and cons of each so you can make the decision that is best for you.

Option 1: Leave it where it is

Yes, you don’t have to move your employer sponsored account anywhere, you can continue logging in and managing it with the plan administration.

Pros

- If you like the investing options and the fees are reasonable, leaving it as is can be the simplest option

- You are comfortable with the plan administrator and you can easily navigate their website

Cons

- If you start a new employer sponsored account, you will be managing an additional account with a separate log-in

Option 2: Roll your account to your next employer plan

If you start with a new employer, they may also offer an employer sponsored retirement account. It’s important to look into the account, the investment options, and fees before deciding to roll over your old account into the new one. Even if the the new employer offers a slightly different type of account (e.g., you had a 401(k), and the new employer offers a 403(b)), rollovers are possible

Pros

- Your new employer plan may have better investment options and/or lower fees

- It’s convenient to have all your retirement funds under one log-in

Cons

- You generally will need to select the investments you desire with the new plan administrator during the rollover, and some of them might not be identical to what you previously had

- You will need to be careful not to trigger a taxable event during a rollover, typically this means ensuring you fill out the right forms and follow rollover instructions closely. Usually, it is recommended that you work with the new plan administrator, who is more than happy to take money from your old plan administrator

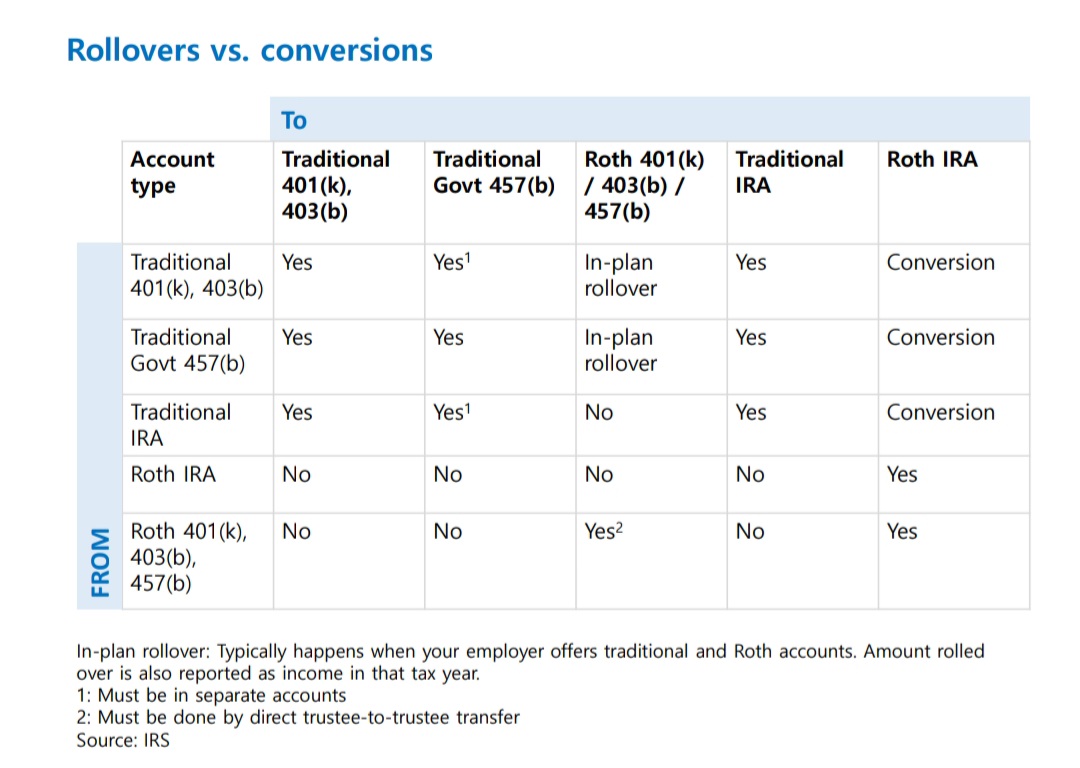

The image below indicates the different directions you can roll retirement accounts

Option 3: Roll your account to a rollover IRA

This is the option that most people are aware of. You move all the money in your retirement account into an IRA (individual retirement arrangement), which retains the same tax status as your retirement account. For most people, this means that you’re creating a tax-deferred / traditional rollover IRA. This can be a great option if you like to manage your own investments or plan to work under multiple employers and want the convenience of one log-in.

Pros

- You are able to roll multiple old employer accounts into one IRA, resulting in one log-in to manage

- An IRA often has more investment options than an employer-sponsored account

- Rolling your employer plan account to an IRA does not affect your ability to contribute to the max yearly amount for the IRA

Cons

- The IRA may charge more fees than your current plan administrator does

- If you plan to do a Backdoor Roth, rolling tax-deferred funds into an IRA may result in a pro rata tax when you decide to execute on a Backdoor Roth . You can find more information on the Backdoor Roth conversion here.

Option 4: Roll to a tax-deferred / traditional rollover IRA and then do a Roth conversion

Converting a tax-deferred IRA to a Roth IRA can be beneficial for growth in the long run, as funds in a Roth IRA grow tax free and can be withdrawn tax free after age 59 ½. In addition, Roth IRAs come with additional benefits such as the ability to access the principal amount 5 years after conversion, without incurring the 10% early withdrawal fee. Continue to refer to the rollover / conversion table shared above for which account types would be eligible.

Pros

- Converting pre-tax funds to a Roth IRA can offer all the tax benefits of a Roth

Cons

- It is optional to have cash that is outside of the IRA, to pay for the taxes on the conversion. If you use cash that is inside the IRA you may be subject to early withdrawal penalty

In closing

What to do with your retirement accounts after leaving a job looks different for everyone, and there is no one right answer. The key is to remember that you have time. Hopefully the comparison above will help you to make an informed choice on your accounts in the future.

If these terms sound confusing to you, you might want to consider my Save My Retirement Masterclass – which teaches all of this to you in just 3 hours of time. Save yourself time, which in return, gives your money more time to be invested and grow – the class more than pays for itself! Join the wait list to get access to the deepest discounts

Additional posts you should check out