Mr. SMC and I love travel hacking – the usage of credit card and loyalty points and miles to travel for free. We do not recommend travel hacking to those who cannot spend with credit cards like a debit card.

By 2019, we had gone through many signups from the usual suspects – I had the Chase Sapphire Reserve, we’d gone through all the Marriott sign-ups available, and with a baby on the way we wouldn’t be traveling like crazy to meet many airline sign-ups. So we focused our strategy on cash-back cards instead. This is unusual for a couple who usually loves to travel, but, we did focus on cash-back cards with points multipliers for categories we spent in – travel and food.

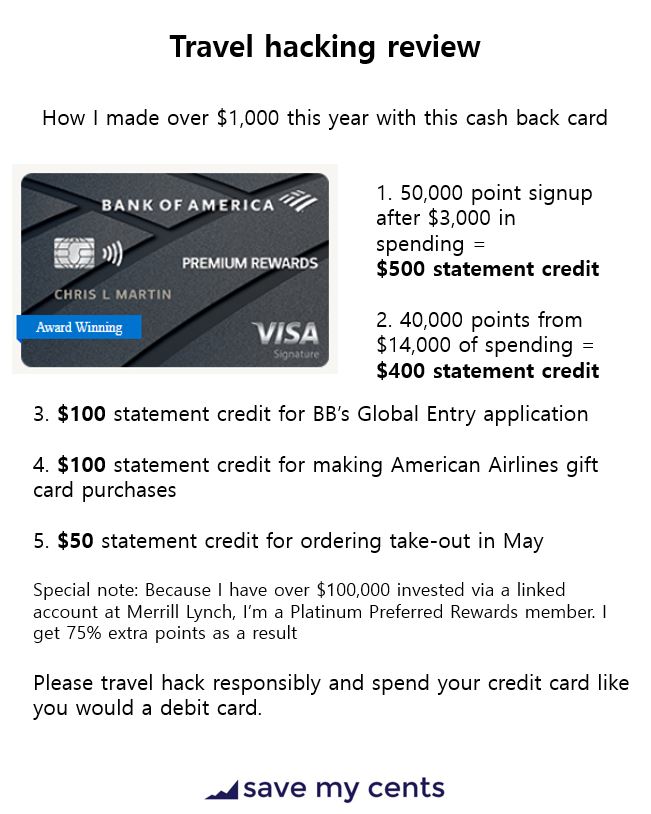

Bank of America was offering a 50,000 bonus sign-up after spending $3,000 on their Premium Rewards Signature Visa. We happened to be making some BB-related purchase when I signed up, so we met the bonus points easily. This card pays 1.5 points for every $1 on general purchases, and 2 points for every $1 on travel and dining.

As a Platinum Preferred Rewards member with Bank of America (I meet the balance through a brokerage account via Merrill Lynch Edge), I get a 75% rewards boost, so I earn 2.625 for every $1 on general, 3.5 for every $1 on travel and dining. The reason I had that brokerage account? Because I would get a $900 sign-up bonus! (this was a hack that I completed in 2019)

We used this card on almost all travel and dining purchases, including our trip to Fiji / Australia / New Zealand. Now that I’ve had the card for 1 year, here’s how our rewards stacked up:

50,000 bonus sign-up points

~40,000 points from our regular spending, which was about $14,000 (this includes a mix of every day spending, travel, and tithe), so an average of 2.85 points per dollar. We do not spend extra just to get points

= total of 90,000, which translates into $900 in statement credit

+ $100 Global Entry credit, which I used for BB’s global entry application. Available every 4 years

+ $100 in airline incidental fee coverage, which we confirmed can be used to buy gift cards, so we bought American Airlines gift cards for future travel

+ $50 in extra dining credits – I received a promotion during the height of pandemic to spend on take-out, so I did, and got free food

minus $95 annual fee

= ~$1,055 in extra value in the first year

Once more in picture form!

As we are not traveling extensively in 2020 this was one of the best hacks we could have done.

The Save My Cents attempted a work optional experiment in 2020 but unfortunately COVID-19 halted our travels. We regularly use travel hacking to travel luxuriously for cheap. See how we hacked a luxury trip to Fiji.