The mission of Save My Cents is to help people with their money one cent at a time, and I am honored to share with Time’s NextAdvisor some ways to make a big impact on your personal finance!

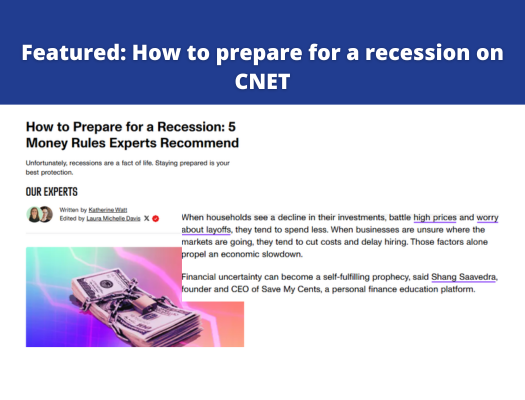

1. This Financial Expert Canceled Her Amazon Prime Account. Here’s How She Shops Instead

In Save My Cents, I advocate for people saving money and living within our means in order to meet the goals we want for ourselves. While Amazon Prime is convenient, it can also reduce the barrier to making impulse purchases, which is why for those who cannot control their impulses, I suggest canceling Prime.

In Save My Cents, I advocate for people saving money and living within our means in order to meet the goals we want for ourselves. While Amazon Prime is convenient, it can also reduce the barrier to making impulse purchases, which is why for those who cannot control their impulses, I suggest canceling Prime.

I give some quick tips on shopping alternatives to Amazon Prime and ways to try an Amazon detox, such as planning orders ahead of time in order to reach the Amazon free shipping threshold, comparing other retailers’ marketplace prices, peeking at order histories to see if we regret purchasing on impulse, and taking a month-long break from Amazon Prime both to see if it can work with your lifestyle and also possibly nudge Amazon into offering a deal if you decide to keep Amazon Prime.

When available, a 401(k) is an incredible tool to help save for your future. In this article, I explain how a 401(k) is a tax-advantaged retirement plan sponsored by employers who choose to participate. Sometimes these 401(k)’s will be a traditional or a Roth plan option to better suit our tax needs.

When available, a 401(k) is an incredible tool to help save for your future. In this article, I explain how a 401(k) is a tax-advantaged retirement plan sponsored by employers who choose to participate. Sometimes these 401(k)’s will be a traditional or a Roth plan option to better suit our tax needs.

In addition, we have control of 401(k) contributions by choosing how much of our paycheck we want to direct to the account. Then, once those contributions are added as cash to our account, we can choose what we want to invest that cash in.

3. 6 Ways to Use the Child Tax Credit Payments, According to the Experts (Who Are Also Parents)

Tax credits can be an exciting windfall during tax season, but the new advanced Child Tax Credit payments rolling out this summer was a true lifesaver for many parents. As a parent, I know that ways to save money on child expenses can make a big difference.

Tax credits can be an exciting windfall during tax season, but the new advanced Child Tax Credit payments rolling out this summer was a true lifesaver for many parents. As a parent, I know that ways to save money on child expenses can make a big difference.

I shared one of my favorite analogies on prioritizing family wellbeing with NextAdvisor about how building an emergency fund helps us individually, which helps us then also better care for those who depend on us. Like the airplane emergency steps of putting our own oxygen masks on first to better help those around us, using available tax credits like the Child Tax Credit to build family emergency funds helps protect us from financial emergencies, which then can create more stability for our families.

4. What Is Universal Life Insurance: A Complete Guide

Life insurance has its place and helps many families in difficult circumstances, but Universal Life Insurance is not necessarily the best plan purely for investing money to reach our financial goals. This article on Universal Life Insurance featured my input that a life insurance policy often has a slower rate of growth than investing in index funds or real estate.

Life insurance has its place and helps many families in difficult circumstances, but Universal Life Insurance is not necessarily the best plan purely for investing money to reach our financial goals. This article on Universal Life Insurance featured my input that a life insurance policy often has a slower rate of growth than investing in index funds or real estate.

I also touch on the point that insurance companies are not required to publish much information about their investment policies—unlike the stock market’s publicly traded companies that must publish reports on a regular basis—so it’s more difficult to see where our money goes.

Do you love seeing practical ways to improve your money situation? Follow @savemycents on Instagram and @savemycentsfb on Facebook today for even more free money tips!

If the article “What Is a 401(k) Plan?” resonated with you, join the Save My Cents mailing list for information on a spot in my Save My Retirement! Masterclass for important guidance about investing for your retirement.