Who likes getting things for free? :: raises hands ::

I began traveling on points and miles as early as 2010, and seriously began looking into travel hacking around the time my husband and I got married. Mr. Savemycents does most of the travel hacking in our marriage, and it can get very detailed. This post will give you a very high-level view into how it works in our household, but it is meant to encourage you to do more research to see how it might work for you

Travel hacking is when you use loyalty points / miles and / or credit card points to travel for free

Most travel companies (airline, hotel, rental car) have loyalty programs. As you make purchases you earn points / miles in your loyalty accounts. These points can be accumulated and traded in for free or reduced cost travel purchases. There are also credit cards – both branded with a travel brand, or unbranded credit cards, that accumulate points as you make purchases, and work similarly – you can transfer points to a loyalty program and then use it to make travel purchases, or redeem them on the credit card’s travel portal.

Not recommended if you don’t treat your credit cards like debit cards

I want to preface that it’s important not to travel hack when you cannot control your spending on your credit cards. The Save My Cents have never gone into credit card debt, we avoid it as much as possible. We pay our credit card balances in full every month and track our spending just as if the credit card is like a debit card. This is a must have rule that I strongly abide by before travel hacking.

Credit card churn – a fast track to earning points

If you are frugal, you might wonder – just how exactly does one rack up a ton of points if you’re also trying not to spend a lot? This is where credit card churn comes in. Credit card churn is basically when you sign up when credit card bonuses are really lucrative. For example, I recently signed up for Hilton Honors American Express Business Card, which would get me 130,000 Hilton Honors Bonus Points after I spend $3,000 in the first 3 months on the card. I happened to know that I would front load a lot of Save My Cents expenses. This included a $1,000+ charge to start a membership with Active Campaign (which manages my email list), so I’m already part of the way there.

The Save My Cents also regularly tithe to very large charitable organizations using credit cards, so that is another way we meet the minimum spends, as our tithing is 10% of our income.

These cards we typically do not keep for a very long time. After a year or two once we exhaust the benefits from these cards, we cancel them. This is because we don’t want to keep paying the annual fees after the lucrative sign-ups.

We are able to avoid big hits to our credit scores because both of us keep a no-fee basic credit card alive that “anchors” our credit files – for example, I have an American Express Blue credit card that I’ve had since I graduated college still active. I put a small $5 monthly charge on it to keep it very active. Your length of history is 15% of your credit score, so combined that with payment history, keeping an old card is a good strategy for keeping our scores high.

We both have jobs that (in normal times) help pay for travel

We both work in the management consulting industry, an industry notorious for travel. While both of us have luckily found niches where we do not need to be on the road Monday through Thursday, we still have plenty of opportunities where we have travel paid for by work. We are allowed to accumulate loyalty points for work travel, and so we are strategic about which airlines and hotels we stay at (as long as it’s within budget!). The Mr. used to travel to India by business class around 4 – 6 times a year, so he’d often fly British Airways, because getting status on British Airways meant that via One World alliance, we would have access to American Airlines flagship lounges in the U.S. I once was sent to Germany for a 3-week project. Over the course of 3 weeks I switched stays between 3 Marriott portfolio hotels, which increased the number of stays I was getting credit for, which pushed me towards platinum status.

How we further travel hack

Travel hacking is one of those frugal habits where the more work you put into it, the more value you can get out of it. Some additional things we do include

- Using category multipliers – for example, if a card gives extra points for restaurants, we’d use that card for restaurants

- Shopping through portals – many airline loyalty program and credit cards have shopping portals, where if you click through the portal before you buy something, you get a multiplier on the points you’d earn from that purchase

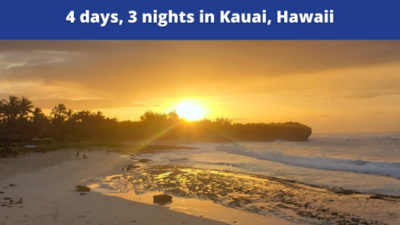

- Transferring to airlines whose redemptions are better than US airlines – oftentimes, non-US airlines have better redemption rates (the “cost” of a ticket as calculated by # of miles you need to spend) for a free flight. For example, we have done the Turkish Airlines Hawaii hack (the trip was ultimately canceled due to my high risk pregnancy), booking open jaw tickets, and purchasing flights to rack up points during really crazy promotions (like accumulating 90,000 Iberia Avios to fly business class one way back from our babymoon).

- Keeping some cards for their free night, and using that free night on a nice hotel. Some of our credit cards, such as the Marriott Bonvoy Business American Express Card and the IHG Rewards Club Traveler Card come with a free night certificate each year. We have used that on some nice hotels in smaller cities when we travel. One of the best redemptions was a free night at the Intercontinental Hong Kong, which we valued at over $900 at the time of booking.

- Actively looking for credit card credit offers. Throughout the pandemic, for example, American Express cards frequently offered credit card statement credits for shopping at restaurants and grocery stores. I think we’ve earned at least $150 or more in credits doing this.

While you’re not necessarily going to get rich from travel hacking, a few hours put towards travel hacking here and there, can result in some really nice free / reduced-cost travel experiences. Follow me at @savemycents on Instagram and @savemycentsfb on Facebook for more tips on hacking travel costs.

You can read a bit about how we might plan out a year’s of travel in this summary post from 2018.

You can see all of our travel posts by clicking this link.