Once I understood the concepts of inflation and depreciation, it was as if a whole new world opened up to me when it came to my own personal finances. I saw that there were ways to build wealth at a faster rate than others, by avoiding these two wealth draining forces.

Inflation

Inflation happens when the buying power of a dollar is less than a dollar in the future. Why does inflation happen? Multiple factors, including a rising population, rising costs of producing goods, central banking policies (such as the interest rates set by the Federal Reserve), market forces going on in the economy, all have an impact on inflation. For the United States, inflation is calculated by the Bureau of Labor Statistics.

In most healthy economies, including that of the United States, inflation exists. If there is a lot of inflation, we have a situation called hyperinflation. If there is negative inflation / deflation, we would also have problems. Here is a sample table that shows what would happen under three different inflation rates

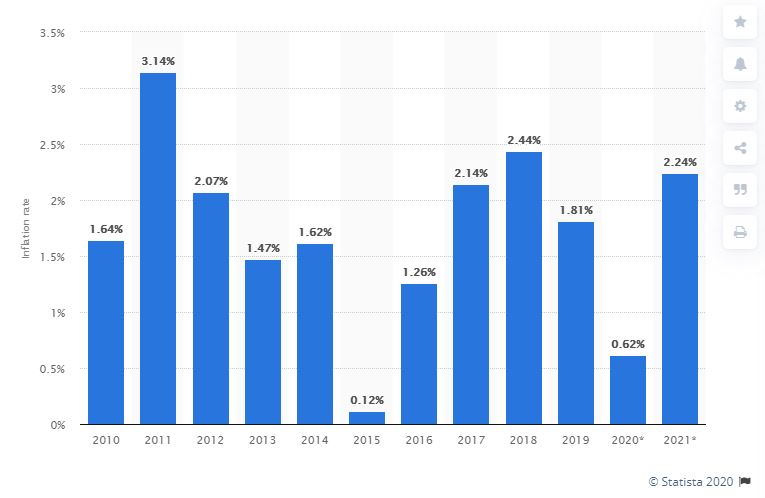

That means, if you wish for your money just to be the same as inflation, you’ll have to invest in something that grows at least at the same rate. What has been the historical inflation rate for the United States? Statista offers a great summary over the last decade.

And that brings me to the point of investing. If you do not invest, if you leave your money buried somewhere in the house like in your mattress, it loses buying power over the time. There are people who do this, these are people with extremely low risk tolerance and a distrust of banks. Keep in mind that the FDIC insures deposits up to $250,000 per depositor per bank and has not seen a member bank experience a bank run since 1934 – that’s 86 years, longer than some of us will live.

And that brings me to the point of investing. If you do not invest, if you leave your money buried somewhere in the house like in your mattress, it loses buying power over the time. There are people who do this, these are people with extremely low risk tolerance and a distrust of banks. Keep in mind that the FDIC insures deposits up to $250,000 per depositor per bank and has not seen a member bank experience a bank run since 1934 – that’s 86 years, longer than some of us will live.

Depreciation

Depreciation is a very different concept, which says that something that you bought, you cannot resell to someone else at full price. This usually happens because of perceived value – the value of your item to someone else is considered, in their mind, not as good as new. This is because they can buy something like new from a store, and think that you’ve used the item, or that it is not as exciting or original.

Here are some depreciation facts to consider:

- The average car loses 20% of its retail value after a year (source: carfax)

- Diamond rings are often marked up for 100-300%, and reselling them results in very high losses (source: The Atlantic)

- The average Apple smartphone loses ~30-40% of value after a year (source: Bankmycell)

In my own experience, I have also found that

- When selling even like-new clothes, I usually can only clear it at ~25-50% of what I paid for it, before fees. I usually sell non-luxury brands

- When I am desperate to move, I will leave furniture out for free

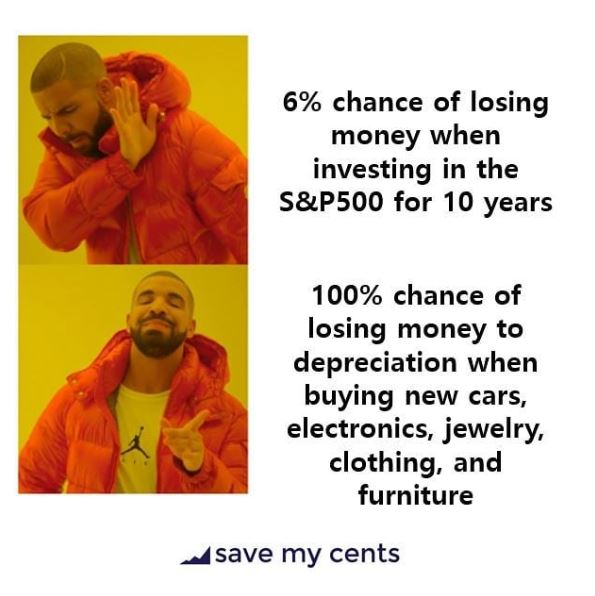

And so I made this Drake meme

The 6% statistic comes from a calculation my friend Ben Tseng did after running a Monte Carlo simulation on US stock market. (Source: Benjamin Tseng) The point of this meme is to highlight how much we under-estimate how much normal stuff loses value, and over-estimate the risk of losing money by investing in the U.S. stock market (the S&P500 being an index and proxy).

I make the point to highlight that this is not to say that cars, electronics, jewelry, clothing, and furniture are investments, but rather, to be aware of whether your fears of investing are grounded in reality. We can be scared, but we should be scared and armed with data.

What I did after learning the above two concepts

To combat inflation, I do primarily two things

- I put the majority of the money I do not need for many years into investments that I hope would grow, including broad index funds

- I put my cash savings in online high yield savings accounts so that at least they are earning interest

To combat depreciation, this is what I do

- I try to avoid buying new. I start by borrowing to see if I need the item, then I look at upcycling, and then I look at buying used

- I do my research to understand when buying a brand is worth it and when it is not

- I understand that wealth does not come from owning stuff that depreciates. I don’t ever look at my clothing and say that I’m wealthy because of my clothes

- I buy new last, and usually try to buy with coupons

Hope that this was helpful. There are very easy and simple ways to help your money work harder for you. Get on the wait list for the next cohort of my Save My Retirement Masterclass to see how easy it is for you to save a retirement.