Financial success is a process. As with any project or goal, the first step starts with implementing good habits that help build and prepare you for reaching the finish line. While I may have reached my goal of being work optional, financially independent, and a millionaire, I would not be here without consistent habits to stay on track. I share a few of my favorite productivity hacks below:

1. Inbox Zero

Inbox Zero keeps your email inbox from exploding. Pioneered by Merlin Mann, emails are converted to action items and most emails are archived so they do not sit in the inbox. I use this method to stay focused on sorting my inbox for (1) items I need to work on and (2) clear items that are not important. I do Inbox Zero once a day, in the morning for work mail and in the evening for personal mail. Learn more about Inbox Zero here.

2. Meal Prep

I meal prep for the week, typically for 1-2 hours, twice a week. I make a large batch of carbs (such as rice, pasta, noodles), a protein (such as chicken meat or ground beef), and a vegetable (such as a salad or stir-fried frozen veggies) and this allows me to put together lunches for myself and my kid in minutes. Meal prep also allows me to save money and eat healthy foods instead of going for heavy take out.

3. Tracking Expenses

I began tracking my expenses starting with the first day of college. The first spreadsheet was so simple it wasn’t even in Excel, it was a Word doc! I had a very simple budget that I entered my expenses in every day – check this out for a screenshot! I found this habit so illuminating because it gave me data on how I spent and showed how I was changing, financially, over time. My tracking eventually moved to once a week, and now it’s around 1-2x a month, only because I’ve gotten better at it and don’t need to scrutinize my expenses all the time. Tracking money doesn’t go away when you have more money. It’s a core financial skill. Need a beginner’s budget spreadsheet? Visit this link to download one that I have made.

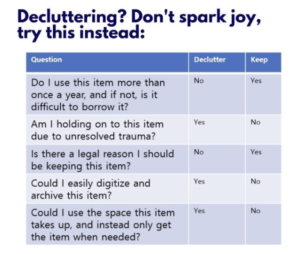

4. Decluttering

About once a month I go through my house and declutter. Some rules I like to use are below.

Unless I know the item is worth the effort to sell (rule of thumb – I usually sell something for about 1/4-1/3 of its retail price), I give it away to my Buy Nothing group or a mommy group.

5. Digital backup

Once a month I back up my photos online (get 10% off with my Zenfolio referral code). I also delete the images I don’t really need on my phone and free up space. This is also when hubby and I download financial statements (pay stubs, credit card statements, mortgage statements, investing account statements) and throw them into a folder on our computer.

These tasks are seemingly basic but essential to everyday life. By planning ahead for these tasks, the minutes that I save, add up to hours in return, allowing me to focus on other more important things and activities in life. These habits are simple enough and doable for anyone to learn and set up. So give it a try and see what might make sense for you!