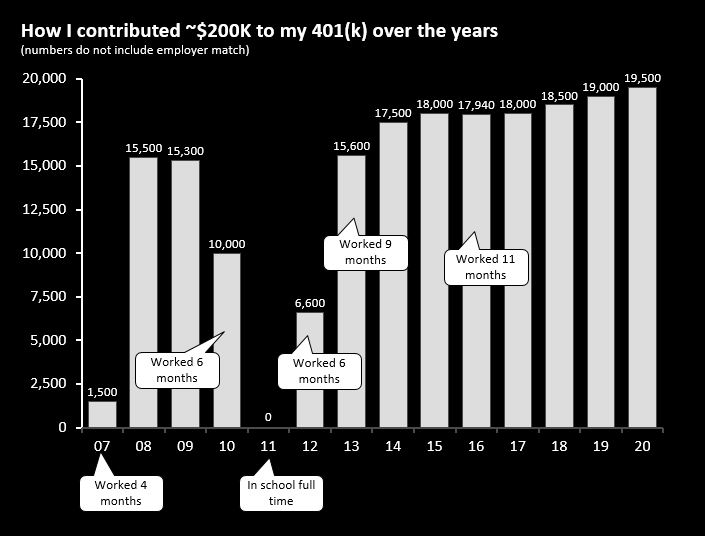

Over the years I have always made it a priority of maxing out my 401(k) to the best of my ability. A few reasons why I like the 401(k):

- Automatic deductions from my paycheck mean that I never see the money – and don’t miss it as much

- Tax advantages of savings on income tax

- Possibility of a company match (though not always offered)

Over the course of 13 years (one year of business school), I did what I could to max out my 401(k). Here are some of the notable exceptions

2007: I began working in September and focused first on building an emergency fund. I made some contributions, but did not focus on maxing it out

2009: I don’t fully remember why contributions this year were slightly less than the maximum

2010, 2012: Both these years I worked a half year. In 2010 I knew I was going to business school so I focused on sending as much as I could to my 401(k). I did find it odd I was again, not as aggressive in 2012, but my guess is that coming out of business school I needed to build a bigger emergency fund

2013: I unexpectedly switched jobs and had a 3 month job search

2016: I switched jobs – expectedly this time. I got as close to the max as I could but had to do it manually, so I was off by a few dollars

I have held 401(k)s with Fidelity, Wells Fargo, and JP Morgan. All of them calculated paycheck deductions using a percentage of my paycheck. Because I am a salaried employee, to calculate what I needed to max out, I took the total annual amount I wanted to send to the 401(k) and divided it over my paychecks. For example, if I had 24 paychecks, and I wanted to send $19,500 in a year, and I made $100,000, the formula is: $19,500 / 24 = $812.50 to be sent per paycheck. $100,000 / 24 = $4,166.67 a paycheck in gross pay. $812.50 / $4,166.67 = 19.5%, round up to 20% to be safe.

In recent years as my income has gone up, I now do it over fewer paychecks – meaning I tend to favor maxing out my 401(k) without waiting until the year’s end. I went very aggressive in 2020 and did it to the max that I could so that most of my maternity pay was sent to my 401(k) before I was no longer paid. This timing is important especially for those who are starting to contribute to a 401(k) partially through the year, but still wish to max it out. You do not have a full year’s of paychecks, so you should probably calculate it over the remaining number, but take away 1 – 2 paychecks because contributions take typically 1 – 2 pay cycles to take effect. Make sure you are already budgeting and learning to live off of a lower paycheck after this deduction – I like using Smart Asset’s income tax calculator to figure out what I’ll get in my paycheck.

If you are looking to understand the U.S. retirement system in 2 hours or less and de-mystify where you can be investing for your retirement, join my mailing list to nab a spot in my Save My Retirement! Masterclass. Masterclass is released via the mailing list first, and then via my website / Instagram.

Are you just getting into investing for retirement? Here are some of my favorite resources (you can click to buy on Amazon to help support this blog!):