A few years after I began my photography side hustle, I worked with a CPA to file taxes as a small business owner with a main income. I was shocked to find that I owed THOUSANDS of dollars on my tax return that year. “How can that be?” The CPA showed that because I made a lot of money that year from photography, I owed significant self employment taxes and income taxes on that extra income. While I beat myself up in the background he prepared quarterly tax payment slips for me.

He never helped address my emotions that day, and thus, I’m writing this blog post to help the rest of us who may be going through some of that right now.

The U.S. tax code is hard and filing taxes are hard because of corporate greed – but many of you can do it for free

Did you know that companies like TurboTax are part of the reason taxes are complicated? For DECADES they have prevented the U.S. from doing what many other wealthy countries already do (e.g., United Kingdom, Australia) – make tax filing free and easy for the majority of people in this country. I personally am of course upset at this. For most of Americans, tax filings do not have to be complicated. For this reason I do encourage many people to consider, if eligible to consider free file (if you earn less than the income threshold – $69,000 for current year). Your local government may also provide tax clinics such as VITA and TCE

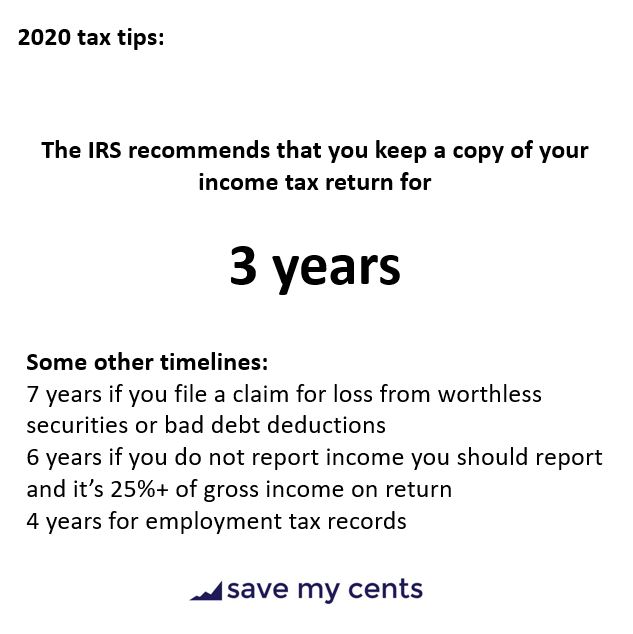

Keep your paperwork for at least 3 years

The IRS recommends that most tax returns should be kept for a minimum of 3 years, although there are some exceptions. Personally, my husband and I are likely to keep as many of our tax returns around as long as possible because we like doing analysis on the past and track our personal finance lives

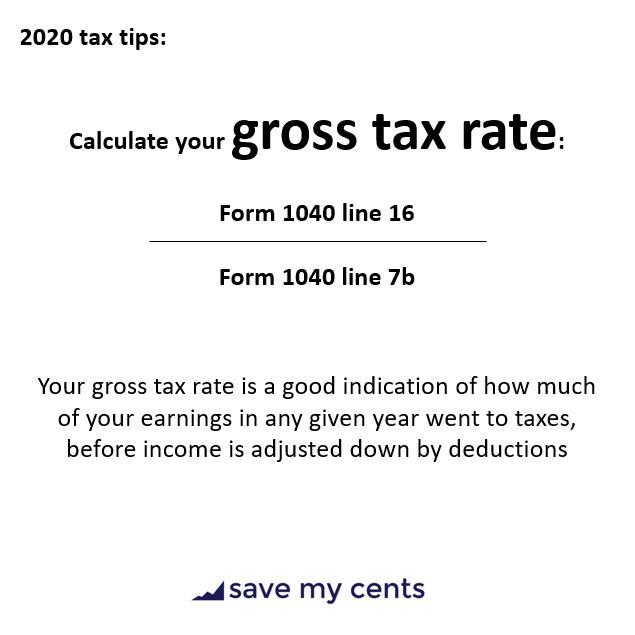

You can calculate your gross tax rate now

Did you know that the U.S. tax system uses a progressive tax rate? That means that as your income increases, your tax rates increase. That is why people always talk about getting into a lower tax bracket – trying to reduce their reported income so that they fall into the lower tax rates. Another complicating factor is also your filing status – filing head of household vs. married vs. single can make a lot of difference in which tax rates are being applied.

To track how much we truly pay in taxes each year, my husband and I calculate a gross tax rate once a year when our tax return is completed. Here’s the calculation

By tracking this rate each year we can easily see years where it is vastly different from others. Typically it indicates either a significant change in earned income, a change in where we live (especially if you change states), or a change in legislation that impacted the tax code.

Think about when you’d like to send money to your IRAs (traditional, Roth, “backdoor Roth”, SEP)

For the most part, I’m a fan of waiting until the tax deadline in the year after, to contribute to IRAs. I’ve already written here about how backdoor Roth IRAs work and how timelines matter, but you can still wait. The benefit to waiting until you file your taxes is that you would have an accurate picture of your AGI, which ensures that you do not contribute and then deduct incorrectly if you are not eligible. It is difficult to retract contributions once they have been made. Make sure your strategy is one that works for you, and consult a CPA if you cannot decide between traditional or Roth.

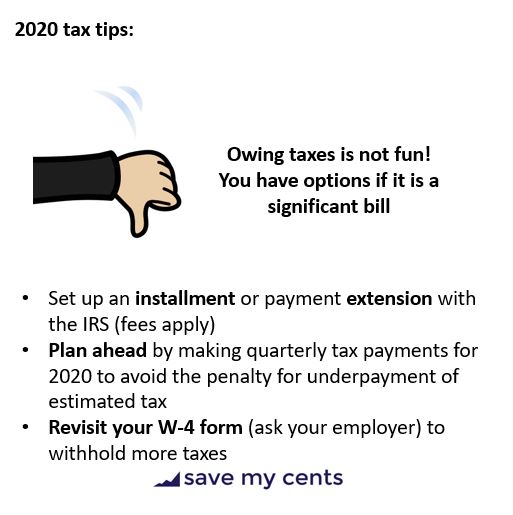

Make changes to your with-holding if you find yourself owing year after year

This most commonly happens to married filing jointly high earner couples, but it also happens if you frequently receive business, interest, or dividend income – you end up owing taxes on making more money. Remember the year that I woke up to thousands of taxes owed? Quarterly filings helped smooth that out for the year following.

If taxes seem confusing to you right now, you are not alone. Definitely feel free to enlist the help of a CPA (they do cost money because of the time invested in helping you, and also they have business overhead). Here are my top tips for finding a great CPA

- Get recommendations and check online reviews

- Make sure they work with clients with similar backgrounds as your household’s (e.g., small businesses, high earners, farmers, etc.)

- They should communicate proactively and come up with good solutions for your tax situations

- They should have informed answers to your hardest tax questions

Then as you prepare for next year’s tax returns, set yourself up with a tax paperwork check list! The best way to do it is to look at your current year’s tax return to see which forms you used, create that list, and then schedule an email to yourself to arrive in your inbox by mid-January of next year to look for these same forms or to file the same forms. Here is a sample for my husband and I:

Forms to file

- 1040

- Schedule C – for sole proprietorship and also because I’m a solo LLC

- 8606 – because of backdoor Roth

Tax forms to look out for

- W-2 – because we are full time salaried employees

- 1099-MISC – if you are a contract or freelance worker

- 1098 – for those who pay mortgage interest on a mortgage loan

- 1099-R – for distributions from retirement funds such as pensions, IRAs, and annuities, but also applies if you’ve done a rollover or conversion

- 1099-INT – for interest earned, typically with HYSA

- 1099-DIV – for dividends earned, typically with a brokerage account that has been invested in stocks

Don’t beat yourself up

I do wish that the U.S. tax code can be simplified, but it is not. It remains one of the hardest topics for me to write about to this date. You can remain informed by bookmarking https://www.irs.gov/newsroom and checking that site about once a month. I’m also a big fan of articles by NerdWallet and Investopedia that go into these topics in great detail with well-researched findings.

If you are looking to understand the U.S. retirement system in 2 hours or less and de-mystify where you can be investing for your retirement and understanding the complex tax code, join my mailing list to nab a spot in my Save My Retirement! Masterclass. Masterclass is released via the mailing list first, and then via my website / Instagram.