Many American parents face a very difficult decision: Should they fund their own retirement, or save money for their children’s college careers? There is often not enough money to do both. Private college tuition in the U.S. has risen tremendously. According to data from U.S. News, college tuition has risen between 4-6% a year in the last 20 years, which is faster than inflation, which in the last 20 years has been 2 – 3%. For even more years of history, you can refer to this chart by EducationData.

This rapid increase in college tuition is causing tremendous stress on both the parents and the students, who have to make difficult choices to make higher education financially possible, and whether to take on five to six figure student loans. These decisions are made even more difficult by external influences such as guilt, peer pressure, social media, and more. It is easy for a parents to feel like they have failed their child, by not being able to help pay for higher education.

Here’s my advice to the parents: This sounds counter-intuitive, but I would rather you focus on securing your own retirement, over and above, saving for your children’s college education.

Children have more time

While it may be less than 20 years for your child to go to college, your child has at least 30, if not 40 years of earning power after that. Whereas you the parent? If you had your child in the 25-35 age range, then you probably have at most 30-35 years left of earning power before you will need to access retirement funds. Your kids are looking at 40-60 years before retirement. A difference of 20 years is significant.

For example, in both my and my parents’ example, I have shown that it is possible to finish saving for retirement in as little as 10 years. Therefore, as time is the one thing that cannot be reversed, we need to prioritize the person with less time for their investments to grow – the parents. In addition, you also do not want to make your retirement so under-funded such that you rely on your children for retirement. While you may have eliminated their student loans, you are still putting them – while they are early in their careers – in a vulnerable position where they cannot save for themselves, because they need to put a lot of money in caring for you.

The money you save now for school, does not have a lot of time to grow

Say your child is 5, and will start college at age 18. If you wish to prevent your child from having student loan debt and are starting to invest in their higher education today, then that means that there are only about 13 years for the money you have invested to grow. Compare that to your own retirement, which has about 30 – 35 years for the money to grow – it is significant. In fact, this is one of the most under-appreciated aspects of compound interest, and why it makes more sense for both you, and your children’s future, to focus on your own retirement.

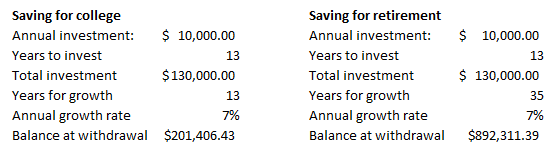

The table below shows what happens when you have $10,000 to save each year, and how much it might grow when used for college, versus when used for retirement. To make this comparison apples to apples, I am having you invest $10,000 for 13 years in each scenario, and then in the retirement scenario, we’d let it further compound. We assume a 7% annual growth rate on investments each year, compounded once a year. If you were to just save for college, you may have ~$201K. However, if you invested for 13 years, and then let the money grow for another 22 years afterwards, you could end up with ~$892K. Not only are you better off by saving for retirement, at that time, you could also consider gifting from your excess to help your children.

Don’t make money a taboo topic with your kids

Even if you may not be able to fully fund a college education and your children may need to take on student loans, how you decide to talk to your children matters much more than how much money you provide them with to start their young adult lives. If your children are able to learn financial literacy at a young age, they can go very far, even on little amounts of income. By talking honestly and freely about money, your kids can learn from you. Being vulnerable about any money mistakes means that your children also see that there is no perfection when it comes to personal finance.

Do remember to keep your money teaching age appropriate. For example, for toddlers, basic counting will do. Elementary school children can be taught budgeting because they’ll have learned arithmetic. Middle school students can be taught compound interest, once they have mastered exponential math.

Another way to help your children avoid student loans is to encourage them – at least for undergrad studies – to attend an in-state public college or even a vocational school, both of which are much more affordable than private college. If your children are gifted, consider doing research early around how to qualify for scholarships – start this process around 9th grade. Consider having them live near home to save on room and board. And if they must still take on student loans, as I have shown above, there are still opportunities later in life where you can help ease the financial burden on your children.

Are you looking for a guide to help you achieve student loan freedom and pay off your student loan debt? Click here to download my 10 Steps to Student Loan Freedom guide.