It takes experience to run a startup. Many entrepreneurs I know are serial entrepreneurs who have a passion for solving problems and bringing new ways of thinking to life. I’m so happy to have connected with a friend who is currently the COO of Trim, a company that can help you save money. Personal finance + startups = my favorite topic, so I’m excited to share with you Jessica Chan’s story below.

Jessica Chan, Trim’s COO

Jessica, you and I met via Harvard and it’s been a long time since I last saw you! Can you tell us briefly how your journey evolved from graduating Harvard right up to joining Trim?

I had absolutely no idea what I wanted to do when I graduated from Harvard! I wanted to keep learning, but I was afraid of getting pigeonholed into a single function or industry. So, I spent my first 3 years out of school in management consulting at Deloitte, where I gained a foundational business skillset and many hotel and airline points.

I became interested in the budding tech and startup space and have since been fortunate to have experienced startups both large and teeny-tiny, spanning industries from beauty e-commerce to SaaS to fintech, and taking me from New York to Southeast Asia and now to the center of tech – San Francisco. I have relished cross-functional roles in strategy, operations, product, and marketing to name a few – my special power is being a Jill of all trades and master of none 🙂 .

I joined Trim a bit over two years ago as Chief of Staff, and now lead operations as COO.

[Shang’s note: Jessica’s resume is super-impressive and the various new ideas she worked on were always ahead of the curve]

For the uninitiated, can you describe Trim in a few phrases? Who can benefit from using Trim?

Anyone and everyone who pays bills and wants to save more money!

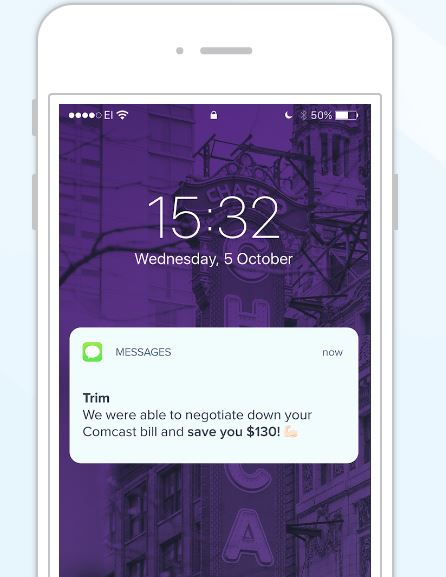

Trim is an automated personal finance assistant (it mainly functions as a desktop website) that negotiates your bills to save you money. We negotiate telecom and medical bills, credit card APRs and bank fees, and even offer an automated savings account. We’ve saved our users over $40 million and counting.

[Shang’s note: Trim also helps identify monthly subscriptions so you are aware of them and can make more intentional decisions on whether to keep them. Subscriptions can be a real budget buster because they add up]

Sample screenshot of a Trim notification

Let’s go back to your childhood. How influential was your upbringing and / or your parents on how you view finance and money today?

My parents raised my sister and me with very modest means. Seeing their hard work and dedication in ensuring a bright and safe future for us has instilled in me the importance of carefully saving, planning, and investing when possible.

On the flip side, such a modest upbringing has also reminded me to enjoy life along the way, and give back to my family and community!

I’m all about mindsets! What is a mindset that keeps you going as an entrepreneur?

As entrepreneurs, we’re always trying to crack a nut – finding the elusive product-market-fit, unlocking unit economics, deciphering investors. It’s easy to get lost in the weeds, but I try to remember that ultimately we’re solving a puzzle. Gamifying the journey helps to enjoy the experience and recognize what a privilege it is to be doing this work.

What is something you wish every American should know about personal finance?

Personal finance is hard! The entire financial system was built against the little guy/gal, designed to widen economic inequality and put more money into banks’ wallets. It’s no wonder that the system is failing so many of us. Change doesn’t happen overnight, but at Trim, we’re working to create real financial health progress for all Americans.

It must have been very difficult to build Trim. What would you say is one of the hardest things your team was able to complete in recent memory?

I am very proud of our team for recently launching a new free trial experience for Trim Premium, a subscription based membership (for $99/year) that unlocks all of Trim’s money-saving features including unlimited bill negotiations, bank negotiations, 1:1 financial coaching, and an automated high yield savings account with 4% APY on the first $2,000 in your balance. It took a lot of moving pieces, a tight focus on unit economics, and a strong consumer product conviction to pull it off.

As you and I know, Covid-19 has resulted in significant financial hardship for many around the world. What are some quick wins people can have right now by using Trim?

Many people have been financially impacted by this pandemic. People can start using Trim’s free trial right away to save money on their bills, and put that toward other critical needs.

Trim is also helping our members access COVID relief programs from banks and lenders to defer payments, waive fees, and more.

Thank you Jessica so much for your time and for the hard work you and your team do to help all Americans with their personal finances!

For daily personal finance inspiration, be sure to follow me on Instagram @savemycents