* This post has been updated with numbers and relevant information for tax year 2025 *

This is, in my opinion, the most complex tax hack we have completed to date. So if you’re reading this and trying it for the first time, you are not alone.

What is a backdoor Roth IRA?

A backdoor Roth is not an official term. It’s more a nickname for a tax loophole that allows high earners who otherwise cannot contribute to a Roth IRA, to still be able to have a Roth IRA in a given year.

Otherwise, if there were no other options, we would be contributing our money to a brokerage, which as I covered in this post, means no tax advantages.

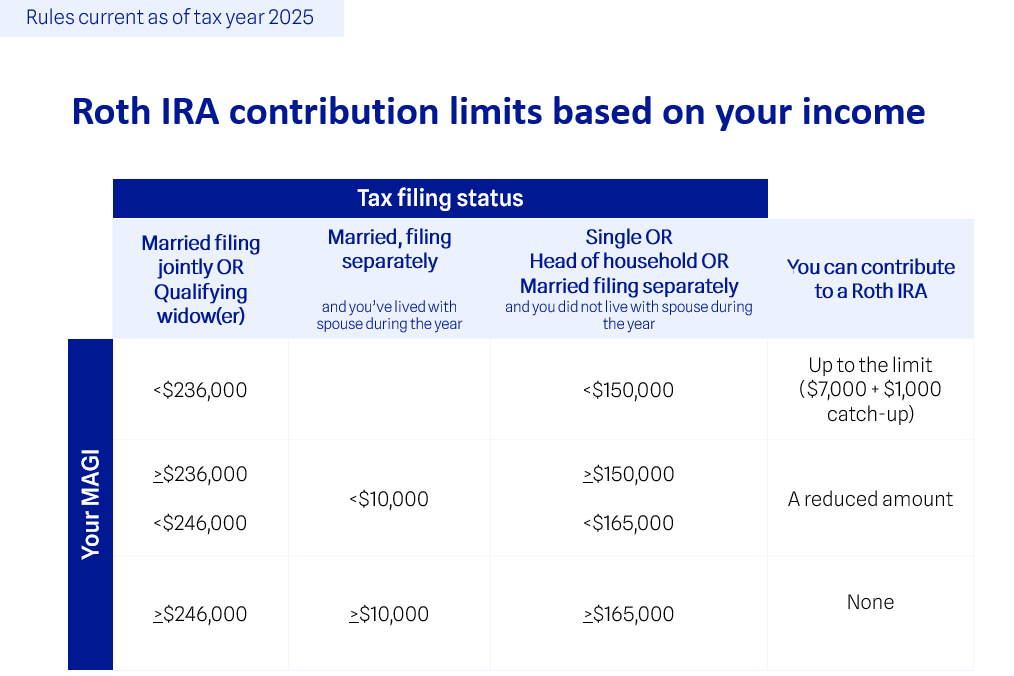

How do you know that you’re above the limit for contributing to a Roth IRA? The IRS publishes and updates the numbers each year, and these are the 2025 thresholds for being able to use a Roth IRA.

For a few years after I earned above the AGI limit for Roth IRA, I assumed that I had no other options, so I just contributed to a brokerage. It was not until another aspiring FIRE friend in 2018 told me they were doing a backdoor Roth, when I began to try one myself. The reason backdoor Roth has not been a hot topic in FIRE until recent years was because for many years people were not sure if it is legal, and in 2018 a Congressional clarification in a few footnotes opened the floodgates for it. Another point of confusion that people have had is that the Build Back Better plan President Biden tried to pass in 2020 also tried to get rid of the Backdoor Roth IRA, but that bill has long been dead.

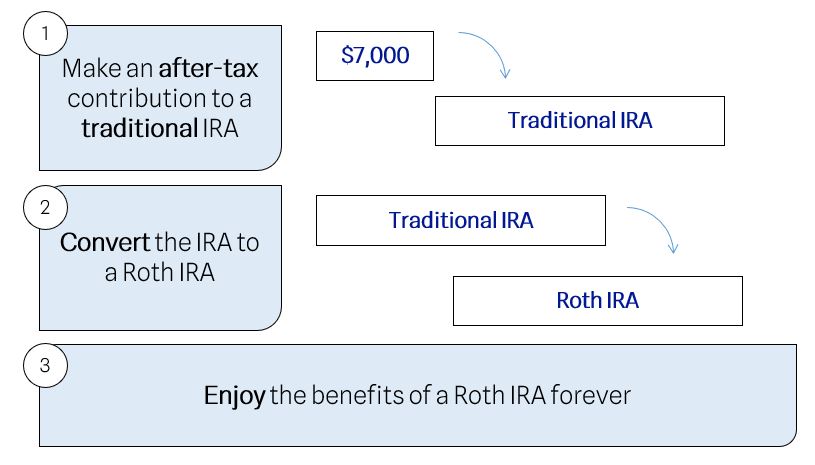

See below for the backdoor Roth explained in just a few steps. Sounds simple right?

Beware the pro-rata rule – this is where you can get tripped up

Generally when you convert a traditional IRA to a Roth IRA you pay income taxes on the amount converted, because most people send pre-tax money to a traditional IRA. In the case of a backdoor IRA, you send post-tax money to the IRA. You have to file form 8606 with the IRS to let them know that the money you sent was post-tax, so that it is accounted for properly.

The cleanest way to do the conversion is right away – before investing. Because if you invest, say, the $7,000, and the investments grow, you would owe income taxes on the growth. Whereas if you convert right away to a Roth IRA, and then invest, that same growth would not be taxed, by virtue of it being a Roth IRA.

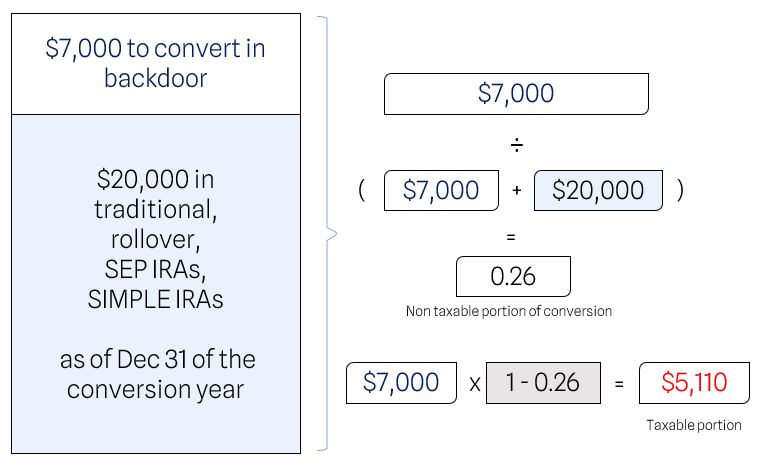

However, in the year you make the conversion, if you have other outstanding pre-tax (also known as tax-deferred, or traditional) money, the IRS uses those outstanding balances to pro-rate the portion of your conversion that is taxable. The accounts are

- Traditional IRA

- SIMPLE IRA

- SEP IRA

- Rollover IRA

If you have a large amount in these accounts, it could lead to large part of the conversion being taxed as income – even if it was after-tax contributions to begin with. (Look I don’t make the rules, I’m just trying to follow them!)

I have created this graphic as an easy way to remind myself of how it is applied. The lesson here is – do what you can not to have amounts that show up in the light blue box on December 31 of the conversion year.

I did have outstanding money in both rollover IRAs and a SEP IRA, so I could not do the conversion without taking care of this first.

Solution 1: Moving my outstanding IRAs to my 401(k)

The way to get around the pro-rata rule is using a 401(k) (or 403(b), 457(b), TSP). Thankfully I was employed in 2019 with a 401(k) that would accept rollovers. I rolled both my rollover IRA and SEP IRA in November 2019 to my 401(k).

Solution 2: Convert everything to a Roth IRA

This one is a bit more financially painful, because if you’re considering a backdoor Roth IRA, it already means you make more money than the average person and fall in a higher tax bracket. If you convert all the impacted accounts to Roth tax status, sure, you avoid pro rata once and for all, but you also need cash on hand (ideally outside the accounts) to pay taxes on the conversion.

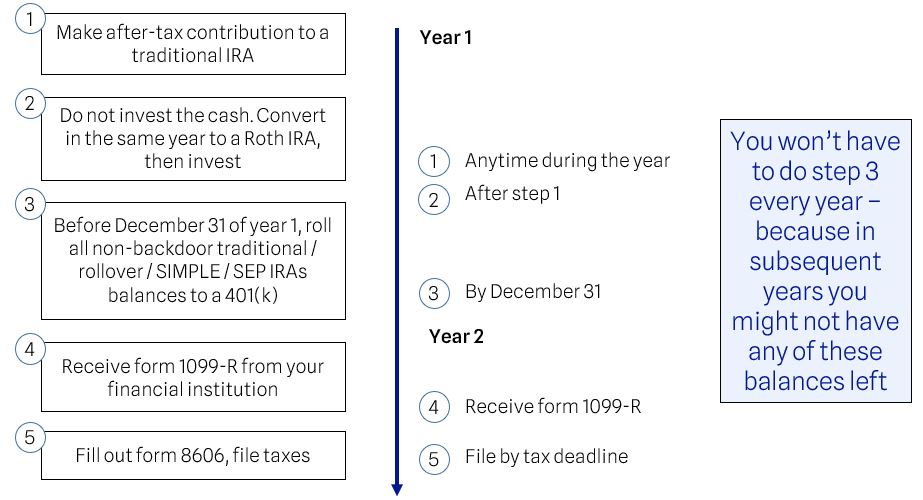

Step by step on how to do your Backdoor Roth IRA in the most optimal manner

- Ensure that all your other IRAs (SEP, SIMPLE, traditional that is not for backdoor) have been rolled into a 401(k) by December 31 of the year of your intended conversion. The IRS only cares about the balance on that date

- Contribute in that same tax year to the traditional IRA

- Convert, right after you contribute to a Roth IRA

- Keep a record of how much you contributed in each tax year and converted, this will come in handy later

- Then invest

- Then file the necessary forms on your tax return, be sure to look for a form 1099-R

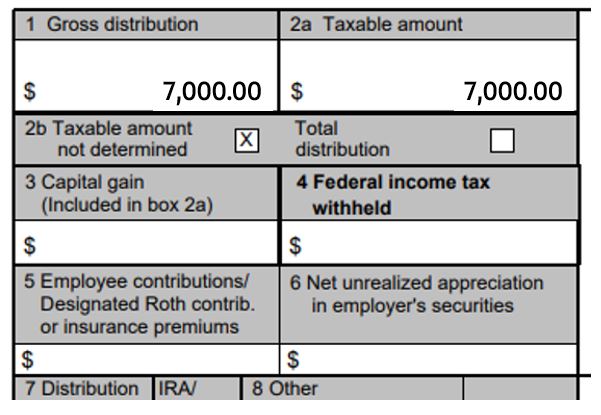

This is what a form 1099-R would look like

You file form 8606 for the tax year you convert, not the year you contribute

A big point of confusion here. You can contribute to an IRA up to the April tax deadline of the year after and still have it count for the previous calendar year.

So for example, you have until the April tax filing deadline of 2025, to contribute towards your traditional IRA, and have it count towards 2024. When you contribute the money, the software will ask you which year to count it towards. Now, in the case where you wait until 2025 to do the conversion, you don’t end up filing a form 8606 until 2026.

Form 8606 gets filled out for the tax year you do the conversion, even if it’s a different year from the year of contribution.

- Example 1: You contributed money for tax year 2022 on April 2, 2024. You converted to Roth on November 1, 2024. You fill out form 8606 for tax year 2024, when filing taxes in 2025.

- Example 2: You contributed money for tax year 2024, on December 1, 2024. You made the Roth conversion on December 31, 2024. You fill out form 8606 for tax year 2024, when filing taxes in 2025.

- Example 3: You contributed money for tax year 2023 by contributing on December 1, 2024. You made the Roth conversion on January 1, 2025. Your conversion counts towards tax year 2025. You fill out form 8606 for tax year 2025, when filing taxes in 2026.

- Example 4: You contributed money for tax year 2022 by contributing on June 1, 2022. You made the Roth conversion on January 1, 2025. Your conversion counts towards tax year 2025. You fill out form 8606 for tax year 2025, when filing taxes in 2026.

For this reason alone, and for record keeping purposes, most people save their sanity and contribute by Dec 31 and convert by that date.

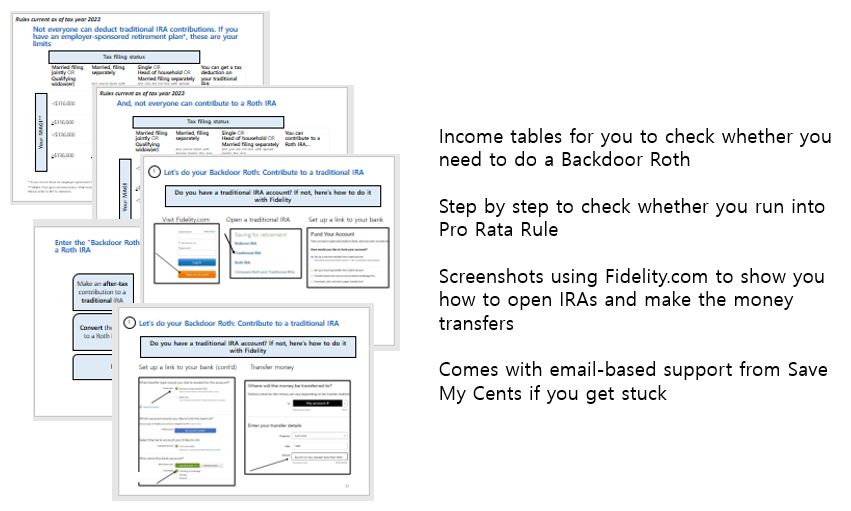

Do you want to get individualized help from Save My Cents on the Backdoor Roth?

Introducing the new Backdoor Roth IRA guide from Save My Cents! It includes all the information you see on this page, laid out in a step by step manner, so you can have the confidence to do your own Backdoor Roth IRA.

To purchase the guide, click on this link to purchase. Purchases are offered through Stripe and are secure. Email based support is limited to 1 email with questions per customer.

To purchase the guide, click on this link to purchase. Purchases are offered through Stripe and are secure. Email based support is limited to 1 email with questions per customer.

If you are looking to understand the U.S. retirement system in a few hours and de-mystify where you can be investing for your retirement, enter your information below to get on the wait list for my Save My Retirement Masterclass

So if you have other money in rollover IRAs (rolled over after you left employment) and you are a stay at home mom so you have no current 401k, does it still pay to do a back foot Roth?

Thank you for all you do! Love the wealth of information you provide! : )