Recently, I had the honor of being featured by Business Insider. In this article, I talk about some basic steps I took to raise my net worth to $1 million by my early thirties. While I also had some help along the way – such as getting my undergrad and MBA education paid for as a combination of my parents’ support and merit scholarships, I explain in the article how there are many other things that people of all ages can be doing to increase their net worth. After all, the mission of Save My Cents is to help change people’s lives through money, one cent at a time.

This Business Insider article highlights three strategies that helped me reach my goal of becoming a millionaire in my early thirties:

Via these strategic habits, my family and I were able to improve our financial security and prepare for various life changes that might come our way.

About me and my path toward financial independence

The road to financial independence for me comes from a rags-to-riches story for my family. I grew up in an immigrant family—a farmer’s family who survived the Cultural Revolution in China. It was by sheer determination that my paternal grandmother (who is illiterate) kept her family out of abject poverty through an extremely difficult time, and our family learned to get by on very little. My dad studied hard to get an education, and he tested into a top school in China on a full scholarship. He was able to move abroad afterwards with my mother and me. He is now a world-renowned professor with a hefty net worth of his own, primarily from his own income as my mother was a stay-at-home mom for most of my childhood. And get this – he didn’t start investing until he was close to his 40s.

As is typical with many immigrants, my parents were super frugal. Growing up, I noticed that my dad negotiated telephone bills and learned how to maintain a lot of the home and yard by hand. My mother couponed, comparison-shopped, and frequently returned items that we did not end up using. My dad taught me about budgeting at a young age—without any fancy budgeting tools or apps—by simply showing me how he tracked expenses and balanced his budget on a notepad. The expenses went on one side of the paper, and the amount of money left in the bank account on the other. When the bank account had no money, he did not spend. He never went into credit card debt. These frugal tips showed the value of always learning, and I desired to study hard and get into a good school. I also grew up with childhood bullying related to a facial deformity I had since birth, which added more fuel to my educational goals to get away from it all.

My college experience and first job

I went to get a degree in economics at Harvard. I knew at a young age that I wanted to make a lot of money, and after crossing out some other common careers (such as doctor and lawyer), I decided on business. I was lucky that my parents paid for college so I would not have college debt, and it is my hope that through my content, many of you would be able to create generational wealth to pay for your kids’ college education as well.

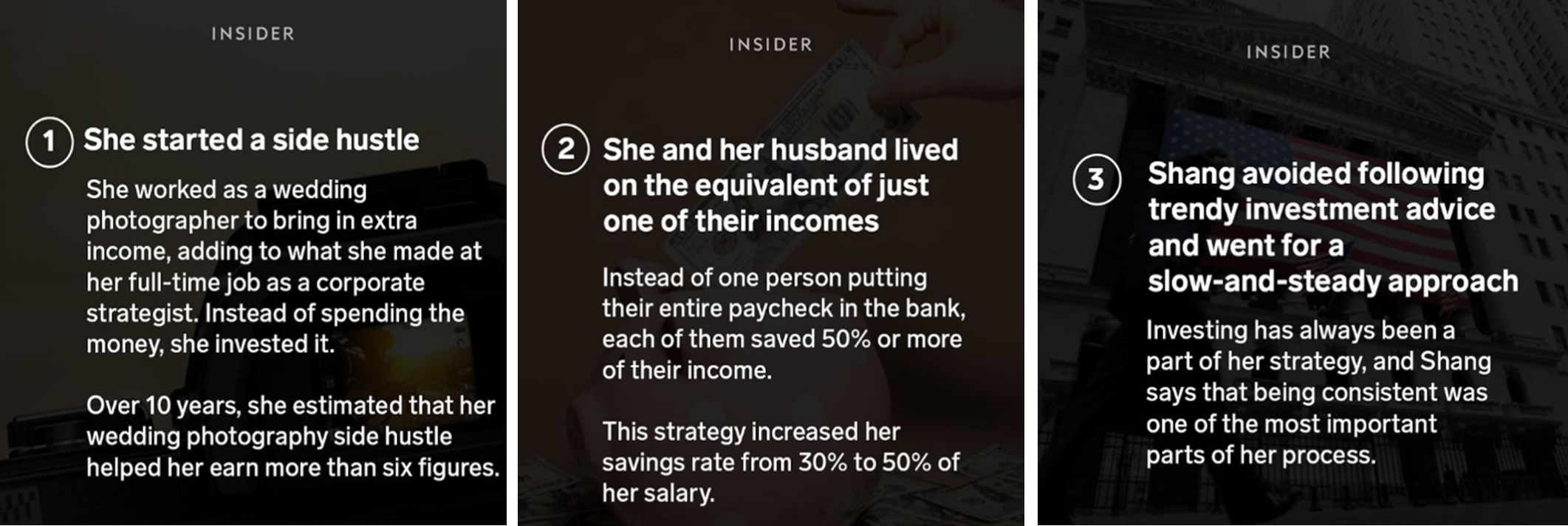

I began budgeting with my first paycheck. I set up a spreadsheet where I could track my expenses every day. In this job, I was lucky that my company advised us in the beginning days not to buy individual stocks, because a lot of our work was on mergers and acquisitions. In that work environment, we may be subject to scrutiny for our trades. Because of this, I’ve invested in mutual funds as opposed to individual stocks and still keep this strategy today. In my early years, I was saving around 30% of my income from my main hustle, and I focused on building an emergency fund and contributing to my 401(k) and Roth IRA. I began a wedding photography side hustle as a creative outlet. This experiment in entrepreneurship would eventually lead to over $200K of profits invested over 10 years’ time, on top of my day job earnings.

Moving to extreme frugality

After a few years in the workforce, I got into University of Chicago for business school. I knew I’d always wanted another degree, and I was very lucky again that I could get my tuition paid for via a combination of merit scholarships and my parents’ support. In business school, I met my husband. During our relationship, he and I decided that we wanted to exit the “two income trap” by learning to live on one income and investing the difference. This would allow us to no longer fear job loss at any time, and also possibly move to a future where one (or even both!) of us could stay at home and parent our future children. At this time, I raised my savings rate from 30% to 50% of my income, which is what led to the foundation of us becoming work optional today. Not only that, but my income also continued to grow, such that I would be making 4x what I made when I was fresh out of college.

We did many things to save money, such as living in a tiny, rent stabilized apartment of 420 square feet for our starter home. We prepared meals that cost only $2-3 per person and used public transportation everywhere. We minimized shopping by keeping old personal electronics instead of upgrading, developing a capsule wardrobe, buying secondhand items, and borrowing other things or going without. For fun (yes, fun!) we found free events to enjoy and started travel hacking, where you can use points for free or discounted travel experiences.

In addition to reducing expenses, we continued investing all of our savings. We keep things boring when it comes to investing: we buy and hold low cost index funds—that’s it! We avoid day trading and do not follow daily trends, because we think long-term in terms of decades, and focus more energy now on earning income and reducing tax liabilities. With income increases and low expenses, in our best years, we were able to invest over 6 figures into the stock market.

Goals of Save My Cents

The mission of Save My Cents is to help change people’s lives through money, one cent at a time. Rather than focusing on the math (it’s a part) and numbers, I focus holistically on mental health, mindsets, and behaviors. When you start taking care of your cents, they grow into dollars and more.

Starting with where you are right now, my goals are to help you save and invest so you may retire with dignity, overcome barriers you might have around money whether mental, generational or cultural, and explain investing in a way that does not make you feel dumb.

Helpful mindsets for your financial empowerment

I have found that the following three mindsets can drastically improve your feelings toward your financial journey. If you feel discouraged when taking steps toward your goals, remember these three sayings:

- “I Get To.” Whenever you are frustrated or feeling down, take an “I have to…” phrase and say it as an “I get to…” phrase. For example, instead of saying, “I have to live in a small place,” try saying, “I get to live in a small place that saves me money.” This phrase not only turns a negative into a positive, but it also helps us identify privileges that we may have, that many others do not.

- “Google It.” Learning does not end with school! If you are reading this blog, you have a super computer at your fingertips and can use it to google terms and concepts you don’t understand yet, on your own timeline. There is so much free information out there, including here on my blog, that I hope you take advantage of.

- “Do It Scared.” The reality of life is that not everything has an answer, and not everything is straightforward. You must take one next step to move forward though, because standing still and doing nothing guarantees no change. Do it scared, but do it anyway! This very phrase is very frequently used by the people I coach on big, scary decisions such as going for a promotion, leaving a job or interviewing for a new job, negotiating salary, and taking the plunge into investing.

These three sayings can help give you a positive boost you need in the moment to overcome obstacles. After all, your mental health is highly related to your financial health; if one struggles, the other one likely will too. Please do what you can to treat your mental health, because your mind is your most powerful organ! What it believes and what you feed it, can manifest in real life changes.

Give your net worth a boost, too!

These Save My Cents resources will help you learn and discover more about personal finance:

- Follow @savemycents on Instagram and @savemycentsfb on Facebook for personal finance gems right on your feed, every day

- Join me for private coaching* for relevant and judgment-free guidance on your finances.

- Take the Save My Retirement Masterclass* to get a firm grasp on your future. Join the wait list today!

*All proceeds from Save My Cents are given away or donated to charity over Shang’s lifetime.