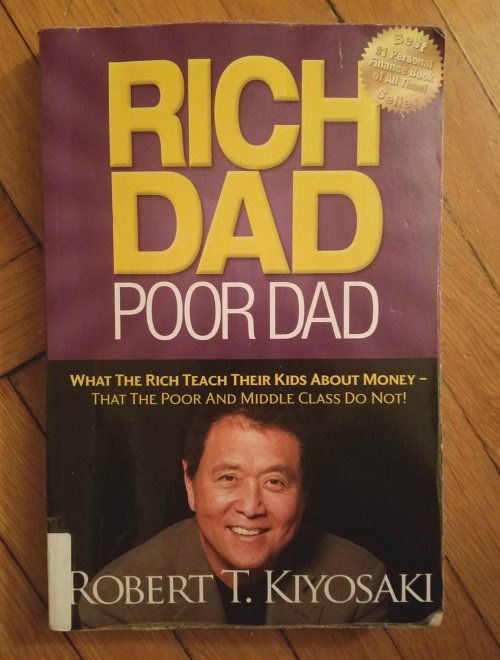

One of the oldest and most classic personal finance books, this book reads more like a fiction novel / philosophy rather than a practical book of how to tips. For this reason, I only recommend this book to those who are motivated via pretty abstract ideas.

I picked this book up sometime in college and I have to admit, I didn’t understand it then. Ten years later, in re-reading it, I can see why I struggled getting through the book. This book is mostly a slow read that helps you understand how a “rich dad” (a wealthy business owner) thinks about savings differently than a “poor dad” (a college educated government worker). The rich dad focuses on investing and scaling a business, and getting a good business deal, and teaches the author, then a young boy, the meaning of earning one’s keep.

Much of the book continues to explain rich dad’s philosophies and why they are different from what most people think when they think of the “American dream”. In fact, in one particular chapter, Kiyosaki explains why the rich hate paying taxes and why they go to such great lengths to avoid paying taxes. Given the current political climate (Kiyosaki is friends with President Trump) it was rather enlightening.

The book does not provide practical next steps until the final chapters, where Kiyosaki explains briefly how he decided to build his wealth via real estate / flipping houses. What he does is risky and requires expertise – one that I do not believe most people who read this blog would be able to do well. For that reason, I don’t recommend the book to most people

Who this book is good for

- You want to break the monotony of working for the man and fast track your wealth accumulation

- Youlike real estate

- You don’t (necessarily) care about getting a college education

- You have a fair amount of knowledge about personal finance from some of the other more practical books I have reviewed

This book’s best personal finance methods include

- Understanding that getting a fancy education degree does not guarantee wealth growth

- A new mindset – one that things about scale, investing in things that generate cash flow, and not getting into too much debt

Where I may disagree

- That everyone could strive to build wealth that Kiyosaki did. I think Kiyosaki is really smart, he is certainly naturally gifted, but not everyone who reads his book think similarly

- In fact, some people who read his book could misinterpret it and go lose money on a risky business or real estate bet

Overall, I think this book is very eye opening, but only to very few people who can see it, and I do not recommend it as your first personal finance book

Does this resonate with you? Join the Saavvy Cents Facebook group to gain access to password-protected posts in the future. Members are added every business day. Want to get serious about saving money? Join the Saavvy10 coaching club to learn to save 10 – 20% of your salary.