It’s January! Historically, within the Save My Cents club, the month of January is a great time to jumpstart your savings because there is not a lot of things happening, so it is easier to save money. I am also taking new coaching members in my club. Successes include helping people build up 3 – 6 month emergency funds, getting out of debt, and more. Sign-up by clicking this link.

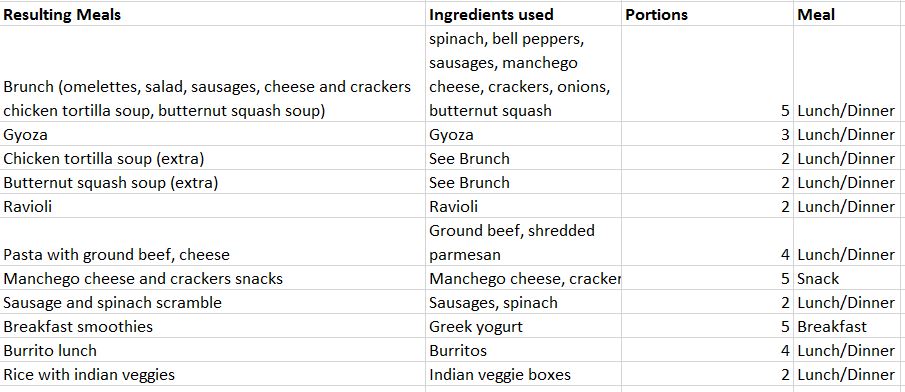

- Eat down your fridge and pantry to the bare bones – Start with the oldest items first, and challenge yourself to eat everything in your pantry and fridge until there is literally nothing left. Exceptions could include spices, and maybe some new sauces, but this gives us a lot of insight into food that we unintentionally keep

- Find one item to give away or sell each day – One thing that I have learned over the years is that… the amount of stuff that people own, is not necessarily a reflection of their wealth. In fact, it is more common for me to observe that homes with lower net worth, tend to have more things, than homes with high net worth. There may be many reasons, but one is likely that psychologically, having a lot of stuff brings a sense of security. This detox allows you to start detaching emotional significance to stuff, and also understand that having a lot of stuff is actually costing you money – in storage space, maintenance fees, and more.

- Repair something that is broken, by DIY – You get something that works again. And, if you learn how to do this yourself, you gain a valuable skill that you will no longer pay someone else to fix for you, which could result in a lifetime of savings

- Set aside 2 hours, on 2 evenings each week, to cook lunches – I typically recommend cooking on Tuesday and Sunday evenings to make lunches for your Monday to Friday job. Cooking lunches typically savings a working person $25 per person, per week. Assuming 49 working weeks a year, that’s $1,225 saved a year, $2,450 saved for a working couple a year. That is enough to fund a vacation!

- Commit to a No Spend Week challenge – A No Spend Week is a week where you do not put money towards anything other than needs. Needs are defined as: rent / mortgage, utilities, minimum loan payments, basic cell phone / cable bill, health bills, basic groceries, basic transportation, basic sanitation cost (e.g., shampoo, soap, toilet paper), and insurance policies. If you cannot do a week straight, pick 7 days in a month to do so. I like doing this over one week (and punting social meetups to a different week) because this very act allows us to identify what triggers us to spend on needs, and then I recommend club members to journal those feelings

- Save every receipt from every purchase, and put them in an envelope by the door – This is an action that I already do, but I learned that many people do not. Put your receipts in chronological order, front to back. Ask for a receipt for every thing that you buy, including cash purchases. Use this to help with your money diary

- Count up your subscription costs for the year – pause all of them for a month – Subscriptions are killer. The first half of “I Will Teach You to be Rich” actually talks a lot about why subscriptions eat at your wealth. Your subscriptions could include TV / movie subscriptions (Netflix), music (Spotify), storage (cloud subscriptions), convenience plans (meal delivery services, Amazon Prime), just to name a few. Subscriptions are “set and forget”, and are a significant driver of lifestyle inflation. Pausing all of them for a month allows you to identify what is a need vs. a want. I go through a more comprehensive exercise with my Club members in order to calculate how much of a “plug” we have to put into each category, in order to ensure that they do not over-spend their monthly budget.

- Take the extra free time to read books from the library – If you pause a media subscription, you likely may free up 1 – 3 hrs extra a day. What to do with all that time? Read. You, your spouse, your children, should all use this time to read instead of watching media. Reading is one of the few ways anyone could gain a vast amount of knowledge, and is a great way for you to gain the knowledge you need to become more financially savvy.

- Learn how to get something used, from a Facebook buying / selling group, or Craigslist – No doubt at some point in January, you might want something. I challenge you, instead of going to a regular retail store – even an off price store – to start looking for it used instead. Look on Facebook buy/ sell trade groups in your local area. Search Craigslist. If you do not live in a densely populated area, check eBay (all items), Poshmark (for clothing), local swap meets, consignment stores, yard sales, or buying direct from a manufacturer. It is not so much you having to buy it, but more to introduce a habit of not buying something new each time you want something. These are all places where I have realized a lot of savings over the years, and it is all about breaking the normal retail mindset of buying something new.

- Find a financial accountability partner – The most important person I had alongside my journey was my husband, who was my cheerleader and coach in teaching me how to pare back my expenses. Financially detoxing, when done in isolation, can feel really lonely. The culture of making money a “taboo” subject, is hurting Americans’ ability to accumulate wealth. The only way we can gain more wealth, is to talk about it, discuss it, and learn more. Find a friend who has always been supportive of your goals, and share this with them. Ideally, this should be a friend who also values responsibility. You might be surprised what you will share with each other and what you will learn from one another

Did you enjoy this post? Please leave a comment in my Facebook group and let me know what other topics I should cover. I need your feedback this year so I can learn how to be more effective at helping others. Thank you so much for reading!