Great question recently from a coaching client:

“I am about to move forward with moving my funds from my traditional IRA to my 401K. But of course right when I was about to do so, I saw how much my account is down. Does it make sense to do this transaction now or wait until the market is back up a bit?”

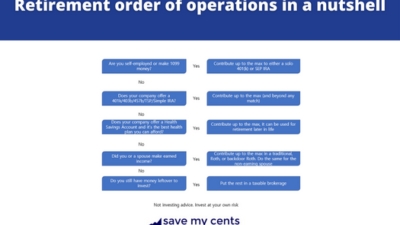

I’d recommended to them earlier to move their traditional IRA to their 401(k) because they’re hoping to execute a Backdoor Roth IRA (a tax hack for higher earning people to have a Roth IRA). When they wrote me this email, the overall stock market had been in decline (October 2023 was a pretty unsteady month in the stock markets due to uncertainty over the economy and global issues). Thus, in their minds, they felt that their traditional IRA had lost value, and wouldn’t a rollover essentially mean that they’d lost money and locked it in?

My response was that it did not make sense to wait. Here’s why

- When you are rolling an account from one to another, you’re not accessing the money per se, all you’re really doing is moving money – and then repurchasing investments, without any impact on your day to day finances. So the value of the account does not truly matter. The value of your account only matters when you need it – at retirement

- While most rollovers involve you liquidating your investments and repurchasing them (in some cases, brokerages are able to match your prior investments and purchase the exact same ones, but because I knew of this person’s exact investments I knew the options did not match up in their traditional IRA vs. their 401k) – and there can be a gap in between – we’re not trying to measure your performance at this point in time. And if you repurchase similar investments once the rollover has been completed, it still does not matter – because if the investments are similar, you’re primarily subject to minor market volatility in the meantime.

- Sure, investments can and do move up and down in the meantime. But think of it this way – if you move $10,000 now, you’re re-purchasing $10,000 in investment assets once you’re done.

- It does matter if you wait too long to repurchase investments. Then, you truly are missing out on “time in the market”, and there’s a high chance that the months you’re spending waiting, result in your investment having had the chance to grow

Want to have more personal access to Shang to receive these kinds of responses? Join the newsletter and have Shang’s retirement strategy emailed to you, and get chances to receive free coaching, free online classes, and more resources.