Personal finance is a series of trade-offs. And sometimes, the trade-offs are not entirely clear, which is why there is so much content out there offering this strategy or that strategy. A few weeks ago I presented some of the most common trade-offs that I am often asked about when it comes to personal finance, and showed why these decisions are very personal, and don’t always have a straight answer.

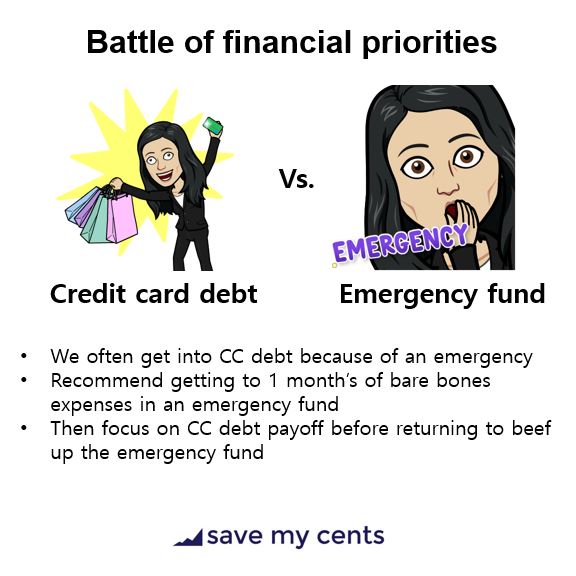

Credit card debt vs. emergency fund – In the beginning it’s hard to pick between competing priorities. Your credit card debt appears to be growing quickly and you’re just getting started on a debt free journey. You are barely up, only to get knocked down. I personally recommend that most people focus on building a starter emergency fund, which I define as one month‘s bare-bone expenses (including loan minimums). I like one month because it breaks the paycheck to paycheck cycle. While building up the fund, make only minimum loan payments. Quick ways to build emergency funds include drastically going to almost no spend, side hustling, selling things, or immediately downsizing your place or taking on a roommate. The beginning is hard. Don’t beat yourself up as you do this.

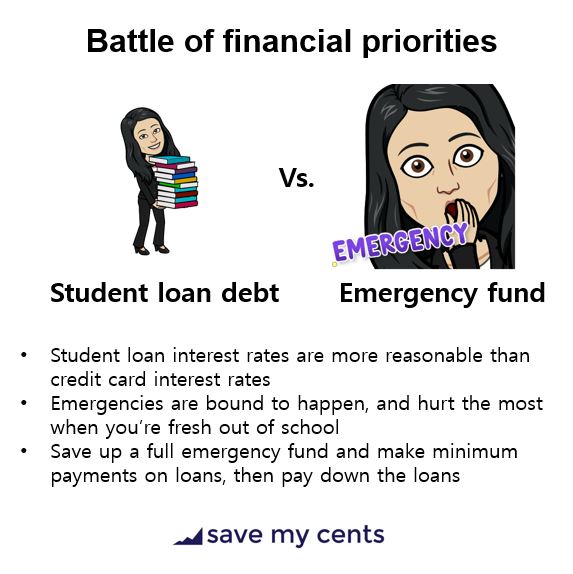

Student loan debt vs. emergency fund – Let’s say you are a recent graduate or close to graduating, and you have student loans. Student loans feel like a heavy weight, often due to the high balances. For many people, I believe it is very possible to pay off all your student loan debt AND retire on time, as long as you use your degree! When you’re just beginning, stick to minimums. Any money you make while in school, be it from jobs, gifts, or even from your student loan refund, put it towards establishing a 3 month emergency fund using that money. Don’t know how much you need for an emergency fund? Ask your friends who are older than you how much things might cost. I know it can be really tempting to pay down the debt right away but you might shoot yourself in the foot by doing so. An emergency is more likely to happen and put you into credit card debt, than for you to have issues with your student loans, so you need to build that buffer with the emergency fund.

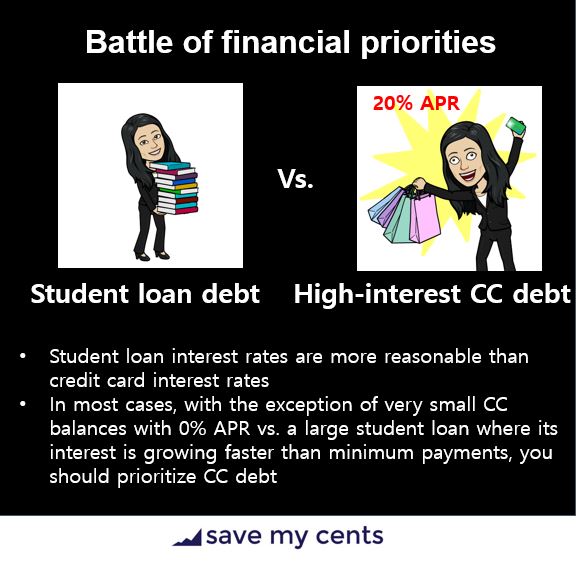

Student loan debt vs. high-interest credit card debt – So let’s say you have both student loan debt and credit card debt. This next bit is primarily focused on US audiences, where student loans have interest rates usually between 4-8% (which I personally think is outrageous, but anyway). Compared to credit card debt where APR could be 20% or more, student loan debt tends to grow slower. So if you have to pick, I almost always prioritize credit card debt. Some exceptions may include… You have some credit card debt on 0% APR, and you have just enough snowball power to wipe out a student loan during the 0% APR promotional period. It might make more sense to focus on that student loan for the satisfaction of paying it off. Another exception is that your student loans have been underpaid due to either forbearance or deferment and are a bigger balance than the original (this is also known as capitalized interest). In this case, the loan is actually more expensive, and needs to be paid off ahead of time. I usually work on distinguishing this exception in private coaching.

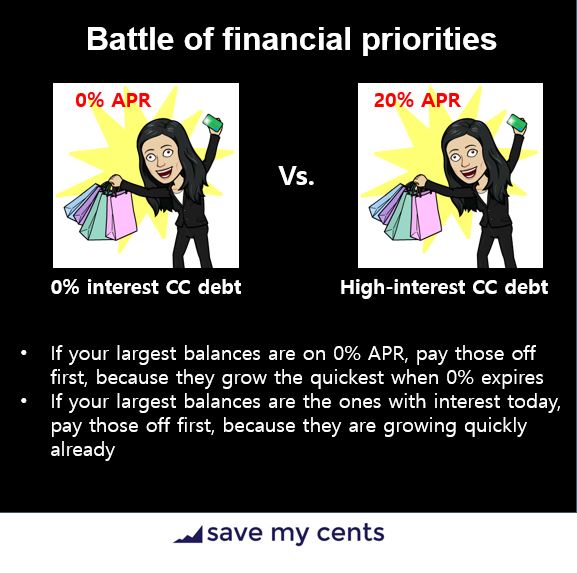

0% APR credit card debt vs. high-interest credit card debt – Let’s say you have multiple credit card debts. Some of them have 0% APR (assuming you qualified for a balance transfer at some point) and some don’t. Which one do you prioritize? A lot of people pay off the credit cards on 0% APR, but that might not always be the case. Let’s say you have a $1,000 on 0% APR for 6 months and $10,000 on 20% APR. In one month, the $1,000 remains $1,000 whereas the $10,000 card grows to $10,167. In this case, the higher balance is growing faster so you should pay that off first.

However, consider the opposite. Let’s say you have $1,000 at 20% APR and $10,000 at 0%. Even after 6 months, the $1,000 grow to $1,104 – it’s fast growth, but not a large amount. And now let’s say you have a snowball of $500 a month. You could make a significant dent in your $10,000 loan by getting rid of $6,000 of it. This is a case where the larger balance makes more sense.

Paying off credit card debt can be a very emotional experience. So in the beginning, if you can’t choose, I always say, pick the credit card that motivates you the most, before going down the mathematically more “sure” answer later on.

Pay off home early vs. invest in the stock market – This one is the most debated and honestly, there is no right answer!

My personal bias given my personal story, is that the stock market on average typically offered a better return than my primary residence and the low mortgage rates I’ve received, therefore I’m missing out on some growth by not investing it. However, this only makes sense if your investing horizon (the time you have left to invest) is at least as long as the remaining time on your mortgage, and it also makes sense if you’re young.

For many people, paying off the mortgage early has not only emotional benefits, but it also lowers the stress and expectation that they need a significant income in the future to sustain living costs. It also makes more sense if you’re going to be retiring soon, and you don’t have a lot of time for the money to be growing int he stock market (let alone survive a recession cycle). The certainty of having a paid off home, exceeds the certainty of making money on the stock market.

Hopefully from the above illustrations you can take away these lessons

- Personal finance is personal. There are general recommended rules, but you need to make it your own

- Run the math before using a “rule”. Sometimes when people write a “personal finance rule”, they miss out on the broader context of other things going on in your life. I often find out in private coaching, for example, that other things that have happened in recent months, or other considerations, need to be accounted for.

- You can’t go wrong if you’re adding to your net worth. Paying off debt and investing are both actions that have the potential of increasing your net worth. It’s awesome if you can do it, because you are investing in yourself!

One book that I really like that talks about people who make these kinds of trade-offs in the long run, is “The Millionaire Next Door“, which discusses the choices that every day millionaires (that you might not recognize on the surface) make, in order to build their wealth slowly over time.

If you want a self-guided workbook on how to pay off your debt, please consider my combo course Five Weeks to Abundance + Debt Free Module. This combination course gets at the emotions of your debt, and then helps you create a customized plan.

If you are looking to understand the U.S. retirement system in 2 hours or less and de-mystify where you can be investing for your retirement, join my mailing list to nab a spot in my Save My Retirement! Masterclass. Masterclass is released via the mailing list first, and then via my website / Instagram.

Great advice here! In my case, I was saving 2x the loan payment every month and this allowed me to build an emergency fund far quicker. That came with a price, of course – I had to downsize some spending, but it was totally worth it.