Let’s. stop. overcomplicating. things.

Yes, there are a lot of ways to save for retirement, and if you’re just starting I want you to do something than nothing at all.

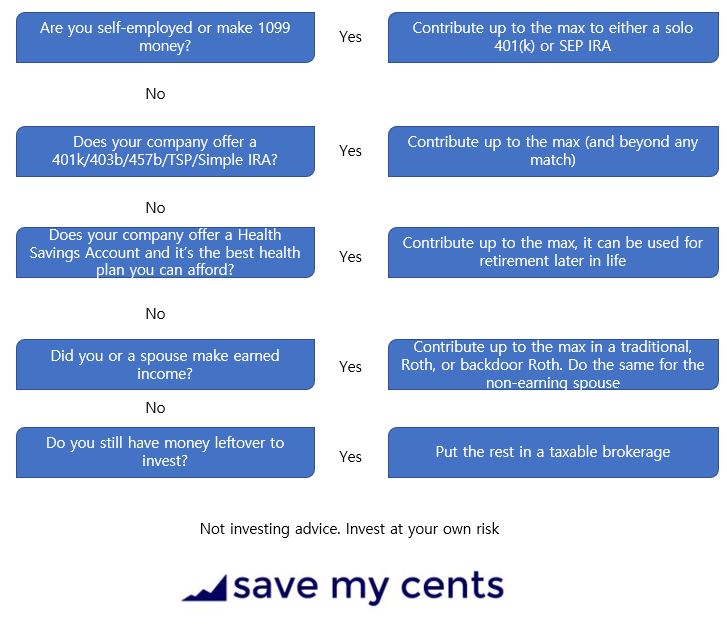

Once you start getting the hang of consistently saving for retirement, here’s a suggested optimal sequence to follow, and I’ll explain quickly why I do this. It does not mean this is the only way – I’ve coached people differently based on private circumstances.

You can use this and more or less apply it to your life, and even if you deviate a little, it’s not going to matter. It means you’re not only active in saving for retirement, you’re doing so without over-tipping the government.

Solo 401(k) / SEP IRA – These accounts allow you to put in a LOT of money and save on taxes – both at contribution and also when growing. This is because you’re considered a business owner (yes your side hustle 1099 income is a business) and that opens you up to more advantages in the tax code.

401(k), 403(b), 457(b), TSP, Simple IRA – all these accounts and the jumble of letters just means, your employer is giving you an account where you can invest for retirement and save on taxes. These accounts are usually either traditional or Roth (your choice), and also investments grow tax free in the meantime. A lot of people make a mistake of only contributing up to the match… but in reality you can contribute way more (for most of these, in 2023 you can contribute $22,500 from earnings, PLUS $7,500 if you’re age 50+), so it’s a huge tax break that people don’t take enough advantage of

Health Savings Account – In general don’t go OUT of your way to get an HSA (I’ve never had one, because my health plans were always better than high deductible health plans), but if you happen to have one because that’s the best health plan you’ve got, these plans have triple tax savings. Money goes in tax free, grows tax free, and is spent tax free if on healthcare. If you don’t spend on healthcare, the HSA turns into a traditional IRA at age 65. Pretty darn awesome

IRAs (traditional, Roth, or backdoor Roth) – anyone who makes earned income or their spouse does, can open one of these. The contribution limits are lower than employer accounts, but, they still allow you to either put in money tax free or withdraw tax free, and money grows tax free in the meantime. A spousal IRA looks just like a normal IRA, you can have access to one as the non-earning spouse as long as you’re filing joint taxes with your earning spouse

Taxable brokerage – I explain in this post why I always put these accounts last – because they provide the LEAST amount of tax benefits. But they are the most flexible. The IRS takes their taxes, but you can do whatever the heck you want with them. So they’re last, but they’re the catch-all

Learn about how to operate like a pro via my Save My Retirement Masterclass, the most definitive digital course that allows you to know how to save and invest a retirement in just a few hours. Class opens for registration a few times a year and comes with unlimited email support from yours truly.