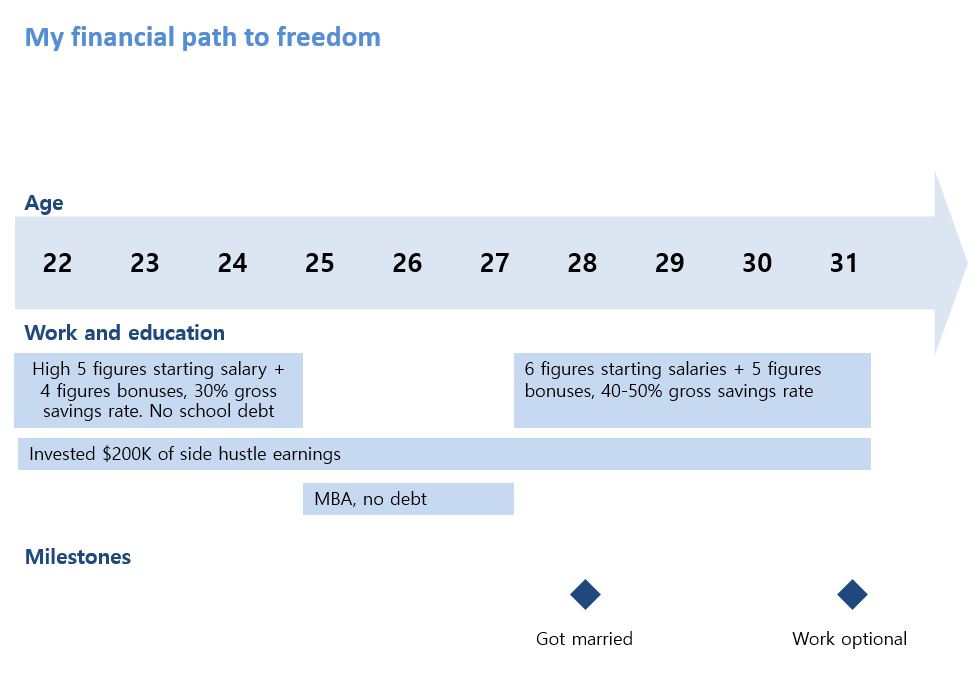

Recently I presented to a college group on the importance of maintaining mental health and personal finances, and I added in this graphic to give the context on my own journey. You can double click it to see it even bigger.

The inspiration for this post was 1) I talk about my journey to FI/RE (financial independence, retire early) recently on The Inspire to Fire Podcast and 2) I liked the graphic haha.

A couple of important notes:

- I attended public schools before college

- My college and my MBA were paid for with a combination of my parents’ invested savings and scholarships. I graduated debt free – a huge advantage and the result of generational wealth, that I always try to mention but sometimes it gets lost in the noise

- When I mention that I had the ability to work optional at age 31 – that was called lean FI/RE. I couldn’t work optional in New York City (now, I can, at age 35), but at age 31, if I’d retired right at that time, I would have moved to the midwest to cut my housing expenses at least in half

- This only shows my side of the story. Mr. Save My Cents had even higher savings rates than I did at similar ages (he’s older). We fully combined our finances upon marriage. His education was fully paid for by scholarships with the exception of one business school loan. He came from even less generational wealth than I did, but on a like for like basis, saved at a higher rate. So this isn’t just my work. It is his work, and his influence on me to do even more with what I was given

- I don’t share all numbers because I pledged to keep many aspects private out of respect for Mr. Save My Cents who is more private than I am

What do I really think about the concept of FI/RE, and do I think it is possible for the average person?

I believe in financial freedom for everyone, but I’m not so sure about early retirement.

There are a lot of things to get right for early retirement to work – especially if you’re talking early retirement in 30s or 40s years of age. You likely have to have most of your higher education paid-for without loans – I see a lot of FI/RE writers either come from generational wealth or have scholarships, or, have attended low-cost institutions such as state schools. Then one thing that is really important to mention – chronic, physical health. Thankfully neither Mr. Save My Cents nor I have debilitating chronic illnesses (physical or mental) that would impact our ability to work at our highly demanding jobs.

The order of operations of key life events can make or break your sequence

If you review the widely available longitudinal studies on the generational impact of some socioeconomic variables on wealth (such as this one by the Brookings Institute), a couple things are very clear. No matter what socioeconomic status you came from, if you do the following in order: complete a degree, get a job, get married, then have children, you are, by and large, better off economically, than people who do any of the above out of order, or not at all. If you follow the sequence above, then I say you are very likely to have FI/RE in the cards for you. One too many times I’ve seen a messy divorce destroy net worth that took years for either side to accumulate. I joke, but both Mr. Save My Cents and I are also at a point where we have a strong financial disincentive to divorce. We have too much invested together.

It’s very difficult to tease out all the causality vs. effects of wealth disparity in this country. None of us really get it right. But longitudinal studies do show how a few decisions in your life on which to do first, can have generational impact (finishing school, getting a job, getting married, and having children, are mostly personal choices – yes I know there are exceptions).

You don’t need a high income to FI/RE, but you do need a high savings rate, which has to be supported by your ability to live on very little

High savings rate typically comes from lowering your expenses – both needs and wants – drastically below what you are making. If you can hack housing (e.g., rent out a part of your home, rent at substantial below market rates, live with parents, live with other families), that is the biggest factor. However, other things that my husband and I did including being very minimal in our food spending, taking public transportation, travel hacking, wearing a minimalist wardrobe, all in part benefit from our good physical health and not having children during our journey to FI/RE. So like I said, FI/RE is possible, but it’s the high savings rate that takes support and a lot of mental work to get to and maintain.

Are Mr. Save My Cents and I still frugal cheapskates to this day?

We review the trends in our annual spending ever since marriage. On whole, there were these major changes.

- Inflation. Our costs in general do increase year over year in line with the overall inflation of cost of goods in the U.S.

- One-time increase in cost structure due to being home owners. We made the “nice to have” choice to buy a home in New York City. With it comes high fixed costs including a maintenance fee that essentially pays for property taxes (which rise every year), union doormen (their salaries also increase every year), and from 2019-2020, an assessment to repair the roof of our building. Thankfully our incomes also rose to adequately meet most of these obligations, and we have a mortgage interest rate of 3.75%

- Increase in our tax structure. With our income increases we landed in a higher tax bracket, and then with SALT deduction elimination, we saw our overall tax rate rise from 20 to 25%, which was significant

- Having our child in 2019. Until he goes to public pre-school, we will be paying out of pocket for full-time daycare once my maternity leave ends

- The unexpected end to #wecanyolonow due to Covid-19 which added additional sunken costs to reroute our travel safely home, move to my parents’ house in the Midwest

Otherwise, we try to control all other costs to be the same. I still have a capsule wardrobe. I still don’t wear makeup on most days. We still buy and cook largely frozen food. We still rarely eat out (pre Covid-19). There are a lot of things I anticipate changing with a child, but that’s okay. That’s what life is all about. That’s what we worked for.

2019: our annual pre-tax savings rate dropped to below 50% for the first time since marrying, to about 43%. (The formula for pre-tax savings is: [Gross income – taxes – expenditures] / [Gross income]). Keep in mind that every year we tithe / donate 10% of our gross incomes at minimum.

2020: I spent most of the year without pay, but also did not have to pay for daycare, and we are able to live off of my husband’s income. Thus, with me returning to the workforce, I calculate a possible annual savings rate of around 30%. We’re not expected to send money to support my in-laws’ retirement.

2021: Assuming life returns to “normal” in New York City, but assuming no significant bonus pay due to Covid-19, and paying for a full year of daycare, I think our savings rate will be around 30%. If I did have full bonus pay, that would have been closer to 35%. In 2021, it is not clear whether we need to start sending money to support my in-laws, so I assume not yet.

All these savings rates are still very respectable, but they are different from our FI/RE build up years. And that’s fine by me.

Because both Mr. Save My Cents and I benefited from scholarships, it is why it is my dream to create a scholarship foundation in my lifetime as well, to pass the gift onward to the next generation.

You can follow more of my daily rambles / personal content on Instagram at @savemycents

I was also thinking about being work-optional in the future and I admit it’s going to be very hard. My field gives a lot of opportunities, but I’ll need a lot of experience as I just moved to another job (despite that it’s in the same field). It was a move in favor of my career, so I hope it will repay in the future.

Another thing I was thinking, was that as soon as I become more experienced in my current field, I could transit to being a consultant and work project-based…but that is a move far away at this point.