The path towards financial independence / retiring early (FIRE) requires two things: Reducing your total expenditures to increase your savings rate, and investing all that money.

This blog post shows a 10 year story of the very first 401k account I ever had. This is my personal story. The past 10 years have been good in the stock market – this is not guaranteed. Then again, nothing in life is guaranteed! Your story won’t be the same. If anything, I hope you can take away from this story that it was about commitment, being strategic, and staying the course.

Set a contribution and commit regularly

I joined my first job in September 2007. I was disappointed to find out there was no 401k match, but my starting salary was more than $50K! It felt like a lot of money to me then! After 2 months on the job, I logged online and increased the contribution from 0% to something higher. I didn’t know how much I should contribute at that time so I first committed to deducting $750 a month / $375 per paycheck.

Summary: When starting out in your 20s, all you need is about 15-20% of your gross income in order to retire at your current level of spending. This game is all about savings rate, not income.

Experiment / try out some investments

The first week at work we were told we should not invest in individual stocks. We work on so many individual deals and transactions it was best we not get charged with insider trading. These were words that probably saved me, because it meant I only looked at funds – which are more diversified than stocks to start. But which ones? I literally googled “asset allocation”. I think Google told me something like 50% in large cap (large companies), 30% in mid-cap, 10% in small cap, and 10% in international.

Of the first $375 deduction, I put $150 in an equity fund. $150 in a fund that I can’t remember what it was. Then $37.50 in a Europe / Pacific focused fund. Then $37.50 in a target date fund – a fund with a year in it, like “2050” that’s supposed to move in a blended way with your age.

Summary: When you are young, TAKE A RISK. Follow what you think you know about the market based on your research, but it’s more about figuring out your risk tolerance. You don’t have to get it right – just start somewhere.

I knew my numbers

I recorded my 401k meticulously using an Excel spreadsheet. Most fund providers show this to you in nice graph and chart form, but I was obsessed about numbers and wanted to play with them. The first column is the date, 2nd column is what I bought. Transaction told me what I did – BUY = buy, DIV = dividend (I got paid!). In December I added a few more funds like the “WFA” and “Spartan Extended” and “Spartan International”. Honestly I just thought that the name “Spartan” was legit sounding (it was a large cap fund) – that was probably a TERRIBLE reason for investing at the time, but it wasn’t a bad fund – it was a market fund, which I’d read was what I should do.

I read that I shouldn’t change my portfolio too much. So I told myself I would only tinker with it at most 1 to 2 times a year.

![]()

Summary: Knowing how your portfolio is performing is what allows you to make adjustments to it, but do not adjust it too frequently. I also did not go into picking funds blindly. No one should! But this research is not rocket science – literally everything I knew at the time came from a few hours of Googling. You literally owe it to yourself to put time towards reading about investment.

I kept going in a recession because I was young

I witnessed first-hand the Great Recession of 2008 / 2009. Take for example the Spartan Extended fund. It was going for around $35-37 when I first started.

It fell to $23 a share around October 2008, then tanked $20 by end of March 2009. That first buy I made in December 2007 at $40 a share just lost half its value.

My father kept telling me that I was young, that I can get through it. My father was right. If you are reading this at ages 60+, you should be moving to more conservative assets and away from risk, at least the amount of money you need for the next 10 years so it does not get tanked by a recession.

I continued to invest, even though the prices did not rise. That $375 per paycheck contribution to my 401(k) rose to $625, then $739.58, then finally to a high of $770.83 per paycheck, as my income rose and I was able to max out my 401k. Towards the end of 2009 prices rose to ~$29-30 for this fund.

Summary: Like health, having children, in personal finance, your youth is your advantage. The younger you are when you started, the more runway you have to recover.

From December 2007 to June 2009 when I left this job, I had invested a total of ~$45,000 into my first 401k fund. Then I made a one-time strategic move

When I attended business school, I benefited from months of not having income, so my tax rate would be lower. When I filed taxes for the year 2012 I did a Roth conversion. I called Fidelity (my provider) and said I wanted to convert my 401k to a Roth IRA.

This triggers a tax liability. By the time of conversion, the portfolio was worth $57K. My effective tax rate that year was around 24%. That meant that I owed 24% x $57K = $14K to the IRS. I had the cash on hand ready from other savings and investments I made that were not locked up in retirement funds.

The beauty of this new Roth IRA is that it would continue growing, with no taxes going forward.

(Also to those of you wondering how I was able to invest more than what was allowed in the 401k limit – our employer has the ability to dump a part of our bonus into the 401k, so it bypasses the 401k limit. Lots of employers can do this, but it is not something that younger people today want as they want the immediacy of cash, which is a shame as you save a lot of tax on your bonus this way)

I did this because I did not believe that my taxes would be any lower when I retire than when I was working, and because I had the cash available to pay the taxes.

I continued to make investment changes as I got smarter

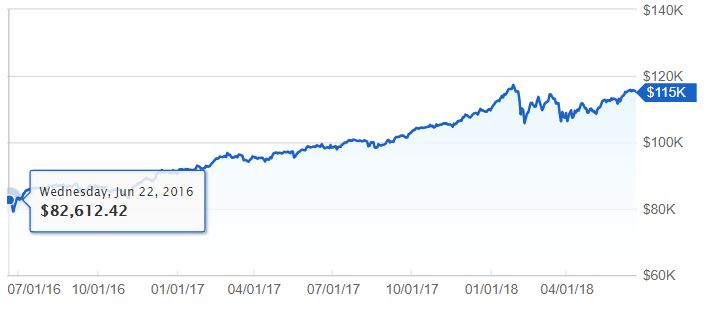

By 2013 when all the dust settled, it had been 6 years since I got into personal finance. Following the advice of what almost everyone said, I put the entire $57K into an index fund that tracked the market – the Vanguard Total Stock Market ETF, which had very low expense ratios, and I let it go on auto-pilot – I haven’t adjusted it since.

The below image is the most recent 2 years of performance of this fund. It has grown from $82K in 2016 to $115K today (as of June 20, 2018). That’s an ~18% / year return.

If you take the after-tax value when the Roth conversion had happened, which is $57K – $14K = $43K, then from 2013 to 2018, this one 401k has returned around 22% in value per year literally without me lifting a single finger. This is the beauty of investment.

Side note: See this Investopedia article on how to calculate your compound annual growth rate, which is the annual return that I’m using in this blog post

Will there be recessions in the future? Of course. Will I be making changes? Probably. Is there a risk I could lose it all? Always – everything in life comes with a risk. This is my style. It has worked out for me.

See daily inspiration on Instagram @savemycents