Investing can sound intimidating, but when you take time to learn some basic habits, actions, and principles, it will come more naturally and can give you the power to reach your “rich life” goals. The goal of Save My Cents is to change your life one cent at a time, and the ultimate skill you need to learn is how to invest your money.

Some of these concepts involve living within your means, curbing lifestyle inflation, and learning continuously, which can provide you with more resources to invest. While there are many investing actions you could take, taking a few simple actions could grant you great returns without a lot of stress. Ultimately, I end with the hope that you focus on what a “rich life” means to you or how you want to attain it, because without focus, your energy and resources can easily be drained. Take it from my personal experience.

*** Please note that all content related to investing on Savemycents.com, the Savemycents Instagram, and Facebook feed, are for education and entertainment purposes, and are not to be considered investing advice. Invest at your own risk, and please consult investing professionals such as robo-advisors for your individual situation. ***

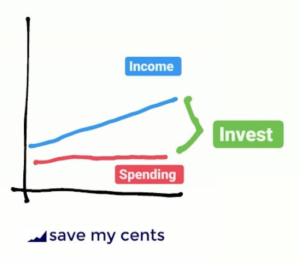

1) Control for lifestyle inflation, so you can invest the difference as income rises

Are my husband and I the super frugal types? Yes. It fits our personalities. I grew up with the Chinese concept of “chi1 ku4” which literally says “eat bitter.” My husband grew up working class. Living within our means was something we learned from both our parents.

In the beginning, my savings came from my habits of being frugal and working a lot. I worked a lot, made a lot of money, and found ways to not spend much. I put all money outside of my emergency fund into investments that compounded, including work bonuses.

When my husband and I got married, we continued to live simply. Before our child BB arrived, we kept lifestyle inflation to an absolute minimum. In addition, since the beginning of our marriage, my husband and I have doubled our household income. By continuing to not count on bonuses from work, investing bonuses, and delaying gratification, we were able to continue accelerating our financial progress.

Thanks to these habits, we have extra wiggle room for big expenses. If we have big (or surprise) expenses, now we can float them in so many ways. We can choose to cash flow it, or we can spend from our investments and not have to worry about it impacting our daily lives.

2) Learn as you go

Learning about investing is sort of like learning a new language – but easier. Nevertheless, there will be terms that you won’t know in the beginning – and that’s okay, we all go through this! Make it a habit to learn terms you come across and seek understanding of general concepts, too.

In investing, the worst thing you can do is copy what someone else is doing without being able to explain to yourself why you are investing in this way. I often prefer that you be able to explain your investing decisions to your teenage self. If I cannot explain it, I do not invest in it, even if others do. Because I answer to my own choices at the end of the day.

At the heart of stock-based investing, people invest in companies because they believe companies want to make money. Companies want to grow and get better at what they do, and investors help provide the companies with money to try to accomplish that.

I do this by investing through an index fund, which is a single fund that invests in stocks from thousands of companies, which reduces the risk that my entire investment would decline in value. I learned about index funds a few years into investing. As I began investing in index funds, I had to learn some terms, including “large cap” (which refers to large companies), “small cap” (which refers to small companies), and “net expense ratio” (which measures the cost of an index fund investment). I looked up all of these terms on the internet, often referring to my favorite site, Investopedia.com

One term I’d really like to highlight is the “net expense ratio” (the percent of total investments that is charged as the cost of you having the fund each year). You want this to be a very low number, because that means it costs you less. A 0.04% expense ratio costs $4 on a $10K investment each year. In general, you do not see these costs on a statement, but rather, they’re built into the return of your fund itself, so the only time you really are aware of them is when you purchase the fund upfront.

3) Research the funds you want to buy, know what you are buying

I really like index funds. The majority of the growth that allowed me to reach millionaire status came from me investing in index funds. Investing in index funds is very simple. You can Google what index funds are as a general term, find specific index funds that interest you, and then buy them. I would not say that my investing strategy is all that sexy, but I don’t really need sexy when it comes to investing. I just need something that works and does not take up a lot of my time – and I’ll explain why later.

This Bankrate article gives you a quick introduction to some popular index funds (again, this is for general education, not investing advice for your specific situation). The easiest way to search for specific funds is by using their ticker symbol, which is usually a few letters that identify a specific fund. You still want to double check that this ticker matches the fund you are seeking before you buy, so you know you’re buying the right one.

In this example, we find that the Fidelity ZERO Large Cap Index fund has the ticker symbol FNILX, circled here:

You can then google “FNILX” to find out more about this fund, such as what it is investing in, its net expense ratio, and more.

When investing, avoid trying to have the “perfect” portfolio that is timed perfectly, because there is no such thing – everyone is guessing when it comes to investing. However, the more money you invest early on, the more time you have to correct for your mistakes as you grow older.

4) Compound interest is amazing

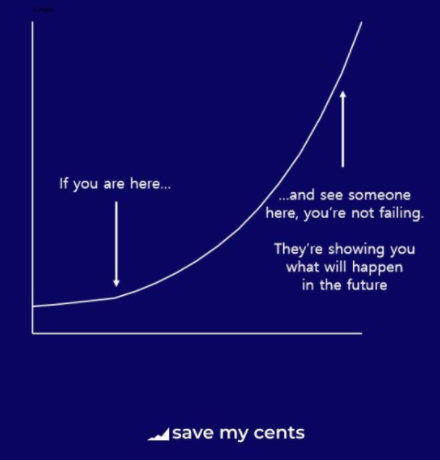

In the beginning, investing does not feel so exciting or look like it will grow exponentially because your base amount is small. Ten percent growth off of $100 is $10… which is not as exciting as 10% growth off of $100,000, which is $10,000. As tempting as it is, do not look at someone else’s 20th year of investing and compare it to your first year. Remember, you are not failing–you are pre-rich! As you invest greater amounts over time, the growth gets much more exciting.

The big question after watching your investments grow is, “When do you sell?” You sell your investments when you need the money. Some people sell only what they need to pay for one year in retirement, leaving the rest invested. Some people might sell a few years’ worth of investments to have a larger cash cushion. Some people might panic during a recession and sell. There is no “right” answer, just the best answer that makes sense for you.

5) Your ‘rich life’ is ultimately about relationships

If there is only one piece of life advice you could walk away with from my content, let it be this: Wealth building becomes meaningless if the ultimate focus is yourself. You need a greater purpose.

I know of so many people who are wealthy on paper, who walk around life without much of a calling, and feeling lost. Over the years I have found that a “rich life” that is focused on material goods, financial stability, and worldly accolades can get old pretty quickly. Not only that, it does not last, and almost no one dies wishing that they could have worked more in their life.

What remains are our relationships with one another. Make them count! Thankfully, it does not take a million dollars to repair broken relationships or build new relationships. Plus your joy will likely compound too! This is really what makes a rich life. That is why at the end of the day, my personal goal when it comes to financial goals is more time, not more money.

Follow @savemycents on Instagram and @savemycentsfb on Facebook for more free wealth-building content to jump-start your path to reach your goals.

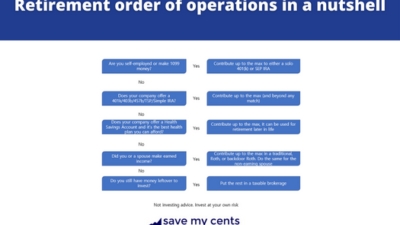

Sign up for my Save My Retirement! Masterclass waitlist to hear about your next chance to join–you don’t want to miss this crash course on planning and investing for your retirement!