One of the most common questions I get here at Save My Cents is – should I get a financial advisor, and how do I know if they are good? After all, investing feels scary and confusing, how does one choose when getting started? Many new investors feel like they need to partner with a financial advisor before making investment decisions. Unfortunately, a good advisor can be hard to find. I’m going to reveal a few reasons why human financial advisors are not my first recommendation when it comes to this question.

Who is a financial advisor?

A financial advisor is a licensed professional who sells investment products. These investment products may include mutual funds, index funds, and / or insurance policies (such as disability insurance, long term health insurance, variable life insurance, permanent life insurance, universal index life insurance, and whole life insurance). If you enter into a professional relationship with a financial advisor, you give them the power to invest on your behalf. A financial advisor may meet with you in person on a scheduled or intermittent basis to review your portfolio. Then, they may take over your investing and retirement accounts (such as IRAs or taxable brokerages) and make investing selections on your behalf.

Fiduciary versus Suitability

There are two main standards for financial advisors: fiduciary and suitability. An advisor following fiduciary standards is legally obligated to act in the best interest of their client, without competing interests such as opportunities for personal profit. An advisor following suitability standards, however, can make recommendations suitable for a client’s risk tolerance and financial goals, but also make money for themselves for personal gain. Here is the part that most people may not be aware of: there are no laws in the United States that require an advisor to act as a fiduciary.

A fiduciary is held to a higher standard. For example, a fiduciary cannot receive commissions or other monetary incentives for selling one investment product preferentially over another. Therefore, a fiduciary financial advisor typically offers lower-cost investment options compared to the commission-based investments offered by an advisor following suitability standards. A fiduciary must also disclose all fees in relation to their recommendations.

Financial Advisor Payment Structure

The problem with financial advisors – especially those who follow the suitability standard – is their payment structure. A financial advisor makes money from you (their client) by charging fees or collecting commissions.

A typical financial advisor may charge roughly 1% on the amount of investments they manage per year. This adds up quickly; if you expect an 8% annual return on your investments, but pay 1% of that to your advisor, your net return is only 7% – that means you lose out 1/8, or 12.5%, of your total investing potential. Compound that over several years, and the loss can be hundreds of thousands of dollars.

For this reason alone, many financial advisors target high net worth individuals as well as high potential net worth individuals. This way they make more money off the same number of clients.

A financial advisor who earns money based on commissions is not incentivized correctly to act in your best interest and should be avoided at all costs. These kinds of advisors are likely to select investments that make them the most commissions, but not necessarily the most money for you. Look out for things such as front load fees and high expense ratios, which usually are a key clue.

Many insurance agents/salesmen operate until the guise of financial advising so it can be hard to know when someone is a fiduciary. I have heard of many people falling prey to purchasing over-priced insurance policies from people they believed to be fiduciary financial advisors. You need to ask them, and then verify! I typically recommend using The National Association of Personal Financial Advisors (NAPFA) to find a fiduciary financial advisor.

Robo-Advisors

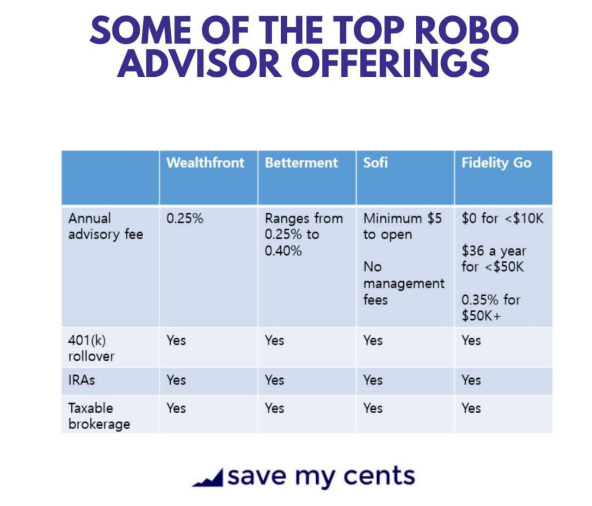

Robo-advisors have really begun to penetrate the financial space in the last ten years. Robo-advisors are automated digital platforms that offer financial planning services with minimal to no human interaction. You answer a few questions to outline your financial preferences and goals (such as your age, household makeup, income, whether you’re saving for retirement or a more immediate goal, how risky you like to be), and those responses are fed through an algorithm (a fancy word for software), which then creates a portfolio for your invested dollars. Robo-advisors monitor your portfolio and adjust your investments over time based on your risk tolerance, and also change as your inputs change.

Things to look for in a high quality robo-advisor platform include: easy account setup, quality account services, goal setting assistance, and portfolio management. A robo-advisor should also give you access to educational tools and resources that you can read on your own.

Since robo-advisors are driven by software, they don’t rely as much on human input, compared to human financial advisors. This significantly reduces their fees and helps you keep more of your investment earnings compared to a financial advisor. This creates the best of both worlds – you receive high quality investing advice, and you do not pay an arm and a leg for it.

It is okay to get help

In the early phases of your investing journey, it isn’t wrong to get help from a financial advisor. Financial advisors can offer guidance, help you control your emotions during trading volatility, and give you confidence as an investor. However, there is a downside to using their services – high fees and lost profits for the client. Many advisors are also not fiduciaries. For these reasons, I recommend robo-advisors; their investment selections are automated, transparent, and affordable.