The theme of this post is: Lifestyle inflation!

{for new readers, BB = almost 4 years old, DD = almost 8 months old}

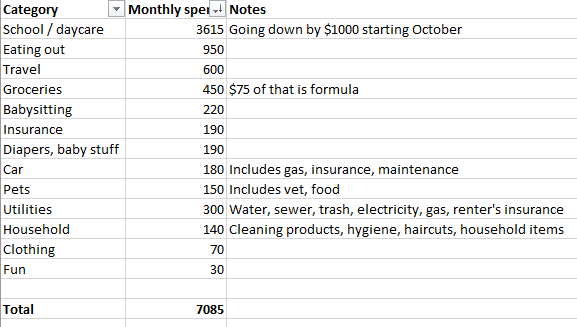

When I last blogged our non-rent costs, it was still a pretty lean budget and it was before the arrival of a second child. I am choosing deliberately not to share our rental costs to keep some sense of privacy (you can definitely take a guess though – it’s high as we live in a nice part of the country).

A few intentional changes:

- We are having DD go to daycare, which added +$2,500 to the budget alone, but will go back down to +$1,400 to the budget in October as I switch providers

- DD also added another +$100 to groceries. And, with BB still wearing pull-ups (he is trained to do #1, but #2 is a struggle), we have a pretty sizeable monthly diaper / pull-up / wipe expense at around $190/month (and some random clothing things in there too)

- I added many babysitters to help me during the early months (I used to have someone come every morning for 90 minutes to help get the kids out the door), which averaged out to +$220/mo, this I expect to go down over time

- Our driving has reduced, so car expenses are pretty low

- We permanently inflated eating out. This includes weekend takeout to treat my in-laws for all the help they provide us, and also allows for nice lunch dates with me and hubby usually around once a week. We’re happy to spend more here

All-in, it’s hard for me to spend money. And seeing these numbers add up (especially the school / daycare) is mind boggling, but I continue to remind myself that we worked for this and we are okay.