I’ve known for a couple years that many FI/RE (financial independence, retire early) bloggers, including myself, are young and naive when it comes to healthcare. It wasn’t until 2022 that I could quantify how naive one could be.

I am so grateful that while the Save My Cents hit our financial goals, we never stopped working and kept having great health insurance. Now, it is possible to be insured when not working. However, most of the time that means spending thousands of dollars on health insurance premiums, deductibles, co-pays, and co-insurances. My husband happens to work for a very prestigious company for whom they had a specially designed healthcare plan that I don’t think is readily available to other companies. It practically covers everything for very little premium.

2022 was a really bad year for me health wise. Part of it was my own fault – I down played a lot of key health events that in retrospect were issues building on top of each other. In isolation I think I could have thought more clearly, but when you’re pregnant, well, it masks a lot of issues. I don’t wish to reveal my diagnosis, but I hope that this blog post can help provide some valuable insight for others thinking about this issue.

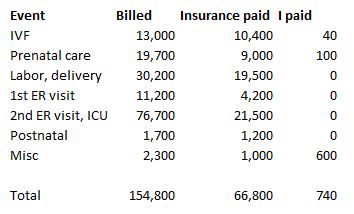

But first, the numbers

This is the summary of how much my 2022 healthcare costs alone were. “Billed” = what the provider (doctor, hospital, lab) charged my insurance. “Insurance paid” = what the insurance plan paid out. “I paid” is my deductible, co-pays, and co-insurance.

I cost the healthcare plan nearly $67,000 and that’s after they’ve negotiated costs down from the $155,000 being charged. It’s a stupendous amount of money no matter how you look at it.

IVF

I extended my old health insurance (the one I had with my old consulting job) for a few more months via COBRA because their IVF coverage was better than my husband’s plan. IVF was fully covered. If this weren’t the case, hubby and I probably would have stuck with our one kid.

This was the cost for the final embryo transfer that resulted in baby DD. Prior to this, in 2021, I’d done an egg retrieval and two embryo transfers, which aren’t shown here. My clinic and reproductive endocrinologist are covered. My COBRA payments I got a sign-on bonus for with my current job.

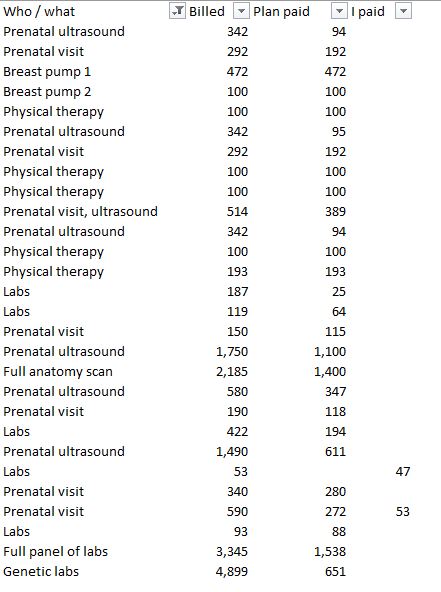

Here is the detail by visit

Prenatal care

My prenatal care was split between two providers, one in NYC and one in Socal, because I moved in September 2022. Both providers were covered by my husband’s healthcare plan so you’d expect very little paid from me.

$100 was my deductible after switching back to my husband’s plan. This also included physical therapy. I’d noticed in my third trimester that I was really really weak everywhere and feeling a ton of pain, so I found an Orange County based physical therapist that my insurance covered (I made sure of this before I began treatment)

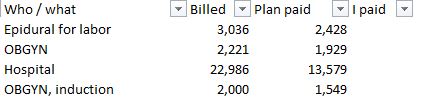

Labor and delivery

I made sure that my labor and delivery hospital of choice – Hoag Irvine – was fully covered by insurance before committing to that hospital. I also had a planned induction – mostly because I personally feared baby DD was getting too big to be pushed out, and because I hoped I could control the process a little more.

By the time I’d delivered, DD was the same size as BB (my eldest), and with BB’s labor and delivery I lost a lot of blood. Thankfully my recovery was slightly better this time around and we only had to transfuse one unit of blood this time.

ER visits

Before you ever go to the ER… heck, when you first get on your health insurance, write down the locations of the 3 ERs closest to you that are covered by your insurance plan. The last thing you want is a giant ER bill because you went to an out of network hospital… and as you will see below, this is the bulk of the costs that were incurred this year and this was to a hospital that was covered.

I had two ER visits. The first one was for what I thought was a minor issue. Then shortly after I delivered, I went to the ER again. At that time people suspected that I had a post partum complication, and because my numbers looked so bad and no one could tell what I had, I spent a day in the ICU while they made sure I was not dying. This was so extremely scary, and thankfully before I was transferred to the ICU my husband called the insurance company one more time to make sure that the stay would be covered.

Get ready for some eye popping numbers.

After enough tests during my 2nd ER visit, it was determined that my two ER visits, though they were months apart, were related, but masked by the fact that I was pregnant, so people didn’t realize what was really going on.

I’m still figuring out my long-term care plan, and whether I will have a chronic issue or not, and whether it would be a pre-existing condition. As we all know the Affordable Healthcare Act now prevents insurance companies from denying coverage and charging more to someone with a pre-existing condition, but it still doesn’t make me feel better. While we continue to treat what I went in for, the reality is that my likelihood of ending up in emergency rooms in the future room is higher than before.

Before 2022, I had NEVER been to an emergency room. And then in one year, I use up nearly $90K in billed / $25K in paid services. For this reason alone, Mr. Savemycents and I agreed that at least one of us is going to keep working and have good healthcare in the near term because even while we could afford to pay for it… we don’t want to take our chances.

Other costs

Funny enough, the cost to me was the most in the other category. This is mostly because my beloved therapist (whose work is so worth it, and who I’ve known since 2014) no longer accepted insurance, and when I saw her last year she was out of network, transitioning to not accepting insurance. Insurance still paid out a little, but from this year onwards I will be paying for her services in cash. I still get sessions with her every now and then

What does this all mean going forward?

- If both hubby and I do decide to stop working, it would not just be using the 4% rule to retire. Our annual expenses would also include the cost of a robust family healthcare plan that we’d buy on the market PLUS the maximum out of pocket costs and deductibles. As it is unlikely we’d ever get a plan that is as good as his company’s now, I anticipate this is an extra several thousand dollars each year

- For people who have a FI/RE number they are aiming for – be flexible for it to change. Especially if you’re young and single and healthy right now, you don’t know what could happen especially as you have kids. Not included in this blog post is another hospitalization related to my first-born

- There are ways to arbitrage health – you can delay some treatments and say, go to Mexico or Thailand to pay less in cash. However, in my case, there is no way you could do this in an emergency unless I was already living in that country

- This is not meant to scare people away from work optionality, but to encourage you all to build a cushion and recognize that good health is truly a marvelous privilege

- And yeah, healthcare in America is broken. I don’t know how to fix it. I’m living the nightmare too