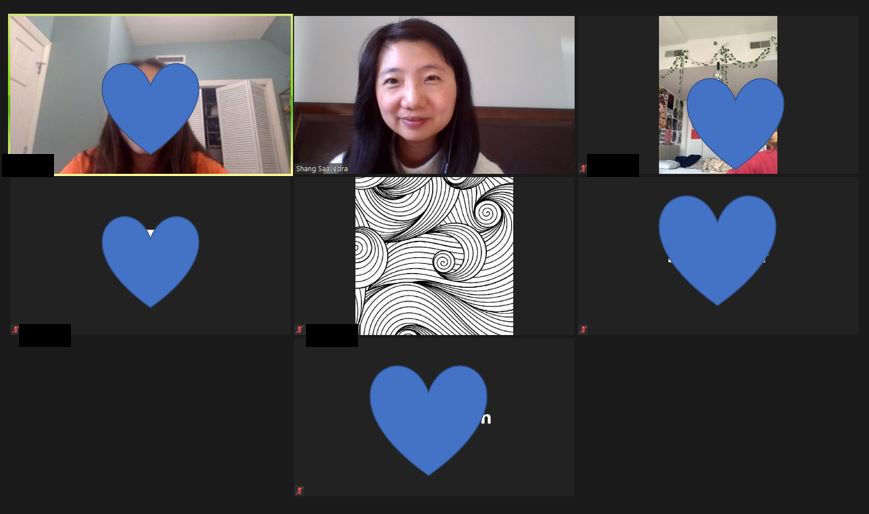

I had the honor recently of dropping in on a high school club that was dedicated to personal finance! I have a HUGE heart for spreading the love of personal finance to young students.

In just 30 minutes, I covered a few concepts that I wanted high school students to know, and then answered some questions rapid-fire before they went on to their next virtual class. Here’s what I shared with everyone:

Three major financial habits you need to know as a teenager

- Save the cash you’re making from your summer jobs, your odds and ends, to create your starter emergency fund. Emergencies are a big reason that drive young people in their 20s to use credit cards, and then get into credit card debt. Having enough to pay for 1 month of life already breaks you free of a paycheck to paycheck cycle

- Avoid credit card debt like the plague! Never charge more than what you make, and pay off your credit card on time. This not only prevents you from going into credit card debt (which is so, so costly and difficult to get out of), but also helps build a good credit profile

- If you have student loans, have a plan for paying off your student loans either on time or early. Do not put your head in the sand after graduating and pretend that your loans don’t exist – they won’t go away. However, if you have a plan for paying them off, you will be well on your way to debt freedom

Some other questions I quickly answered from the audience included:

What are some unexpected expenses I didn’t know about, when it came to my first paycheck?

I had no idea that taxes took so much out of my paycheck! As a good rule of thumb, assume that you’ll pay about 25% of your income to taxes. So never budget off of your full income – only the income that is after taxes.

Why did I start doing a capsule wardrobe?

I look at people like Steve Jobs, Mark Zuckerberg, Warren Buffett.. extremely wealthy business people, who don’t bother having a lot of diversity in what they wear. I look at the time that women spend getting ready and selecting an outfit in the morning, and saw it as a fundamental disadvantage for being female. So having a capsule wardrobe changes the whole game for me.

How can we start building a good credit profile now?

If your parents are willing and also responsible with money, have them add you as an authorized user to a credit card of theirs – but they need to be paying off these cards, otherwise you’ll get bad credit with them. Then, you can sign up for one credit card when you start working. Pay it off in full, on time, every month, and you can rapidly build up your credit score in just about 1 – 2 years of time.

How do we avoid lifestyle creep?

Listen to yourself. Know yourself. And make sure that you’re taking care of future you (the person, who, from the age of 50+, might not have steady income to count on), as well as present you. Don’t follow influencers and other media that tell you to YOLO and are paid to sell you a lifestyle. You don’t need others to define it for you. Define it for yourself.

Are you a teacher, a high school student, interested in having Shang be a guest speaker to your class or club? Please don’t hesitate to reach out here. I don’t charge!

For fun and helpful personal finance matters fit for high school students, college students, and all adult learners, follow me at @savemycents on Instagram and @savemycentsfb on Facebook (and don’t forget to grab your limited-time free Save My Cents guide 10 Steps to Student Loan Freedom!).