Credit card debt is one of the most toxic forms of debt to have because it is so easy to generate the debt, and the interest rates are so high, that it can snowball quickly into something beyond your control.

Even if you have credit card debt, it does not necessarily mean you failed as a person. In my years of coaching people privately I have seen so many smart, good-hearted people get tripped up by things beyond their control. Abusive relationships. Divorce. Death of a loved one. A bad health or mental health emergency that was difficult to pay for. Your debt is not your self worth.

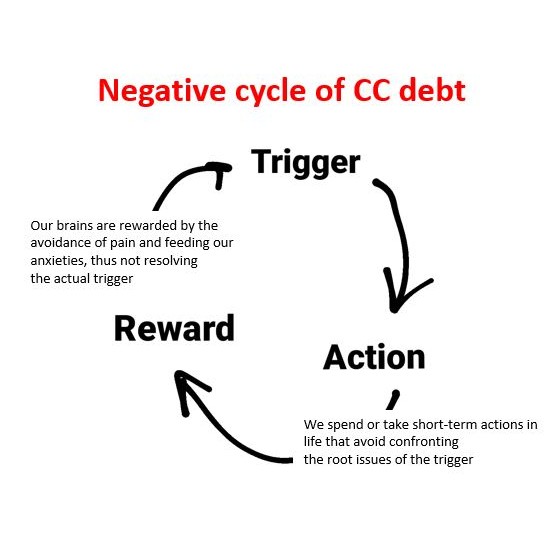

However, the start of the debt or the unconscious accumulation of it, can result in a mental cycle from which it is difficult to exit. Here’s why:

Once your debt exists, it creates stress in your brain. You have a hard time thinking when you’re stressed, leading to a brain fog. The brain fog leads you to make decisions that are not perfect – which then plunges you into worse off situations, which then lead to more debt. That’s the vicious cycle.

Oftentimes, you make these decisions / take actions when you are triggered by something. And usually, the trigger is related to how you got the debt in the first place. Here are some real life examples from people I have coached. All names are made up.

- The anniversary of her father’s death triggers Sonia to over-spend on eating out to get over her grief

- Being reminded of her credit card debt caused Angela to feel worse about herself, and then she goes online and buys a pretty dress from Nordstrom to feel better

- Sarah is bored at her under-paid, under-appreciated job, which does not pay her enough to get rid of her credit card debt. She browses restaurants out of boredom and orders takeout for lunch

- Justin lost his apartment because of credit card debt that he racked up trying to make his wife happy. They move in with Justin’s parents. Whenever Justin and his wife fight, Justin goes out to buy a gadget

These are all examples of the Trigger / Action / Reward cycle that I discovered when going on my own journey to FI/RE.

Wonder what your own triggers are? Consider some of these

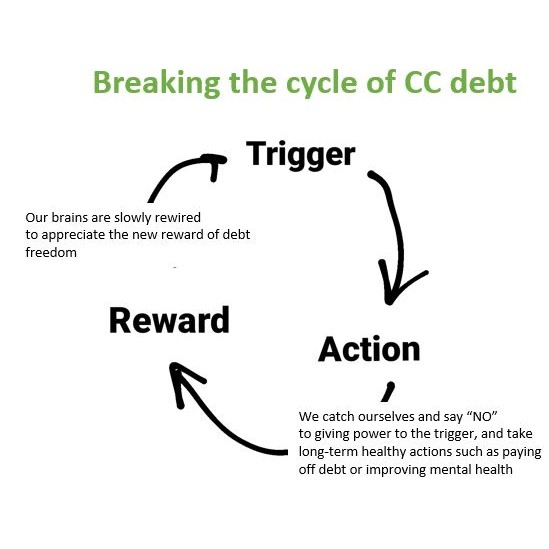

Here’s the good news. You can break the cycle, using the power of your mind. This is what is commonly referred to as the abundance mindset or the growth mindset. The key is to recognize when you are triggered, and “catch” yourself with those thoughts, and say “no”. You need to stop those thoughts before they spiral you further into anxiety and action.

Once you are able to catch yourself, you have the choice. You have the choice to either do everything like you did before and perpetuate the cycle, or you can decide that you want things to be different. You will believe something different about yourself, and take steps towards a healthier mindset. As a result, you may likely spend less, pay off more debt, and exit your way into debt freedom.

I’ve been developing the Trigger, Action, Reward technique for years, and I’m very close to a way of releasing it as a course. I can’t wait to reveal it, coming Summer 2020!