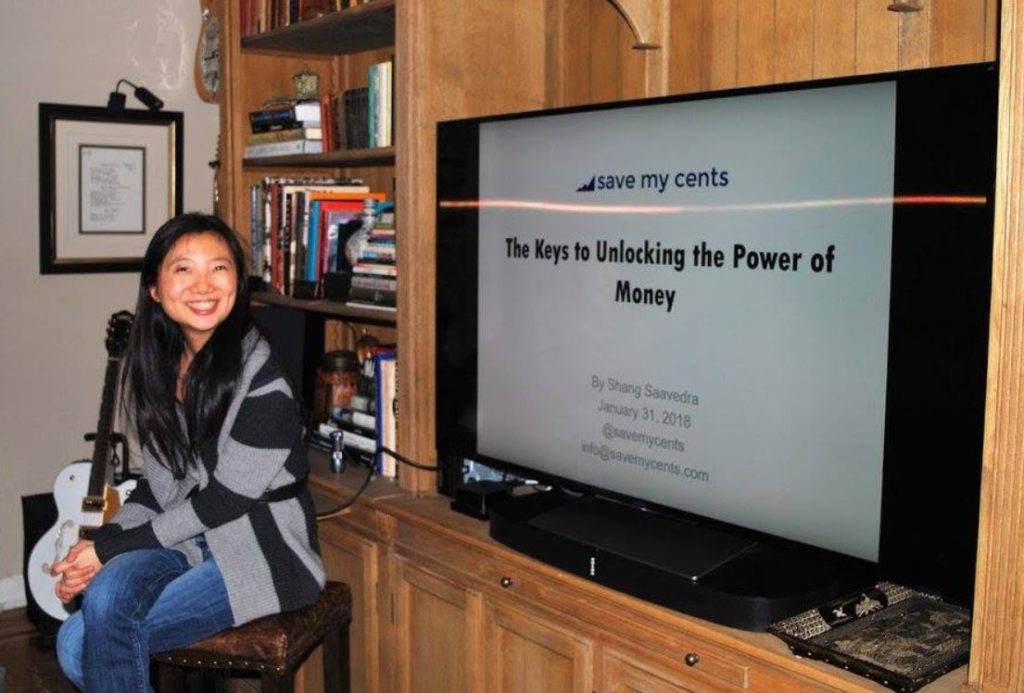

Earlier this week, I had the privilege of presenting an introduction to personal finance workshop to an incredible group of young women looking to become more politically active, who are members and friends of She Will Rise. She Will Rise aims to advocate on behalf of issues that affect women, bring about effective social change, and create social opportunities for mentorship, networking, and friendship, in New York City. They are also on Facebook.

I spoke a lot about why it was important for these ladies to begin paying back debt and building net worth today. Just think of politics. How much more easy would it be for you to run for office if you had money, knew how to raise money, and manage money effectively? Money and power go hand in hand. It’s important to be a financial feminist.

I fielded many questions afterwards, some I have transcribed / anonymized below, with some enhanced answers, so that all of you could benefit.

Q. How do I start my personal finance journey?

A. Track your spending – use an app (I love YNAB!) or even just paper and pen. If you don’t know where your money is going today, that is not an acceptable answer in personal finance, so start gathering data! It’s like fitness tracking, step tracking, or calorie counting. You can’t get better until you have a base.

Develop the ability to be okay with being uncomfortable and being patient. Saving money requires those characteristics, and if they do not come to you naturally, practice it. This could include… walking further to get cheaper parking or cheaper transportation. Be willing to give up an item you love / abandon an online shopping cart for 7 days before you buy it. Willingness to carry very heavy grocery bags and skip the taxi ride. Willingness to not be wearing the most perfect item for the weather.

Q. I have about 4-5 figures of credit card debt. It is so stressful. I don’t know where to start.

A. I hear you on the stress. The worst thing you can do is let the fear of stress take over, and do nothing. No, face your fear, and do something today. Make it your goal for the next few years to achieve the sweet, sweet state of freedom.

Depending on how stable your job is, your first goal is to build up an emergency cushion. Dave Ramsey says $1,000, for some people in my club it is 3 to 6 months of basic expenses. For people who are freelancers, have family to support, work in shift based or part time jobs, the cushion has to be a bit bigger only because the risk of you putting life on credit cards is so high. The second part is paring back your spending, even if it is just cents or dollars at a time, to start backing out money to pay off the debt. It adds up! Keep thinking of the freedom, and what it means to you, your family, and the people whose lives you want to impact. Debt payoff, I promise you, will feel joyful once you start. Money doesn’t always have to be a source of stress, it can be life giving.

Q. I have several credit card loans and some student loans. Some are on zero interest balance transfers, some are not. Which ones do I pay off first?

A. How much balance do you have left on each of the loans? How high is the interest rate for each of them? What is the term on the student loans (how long before it is due)? All these influence your monthly payment, and we have to calculate which ones create the most financial burden in the time period we are talking about. In short, I favor the following. 1. Getting rid of high interest. 2. Getting rid of high monthly payment ones. 3. Ensuring that the zero balance cards are paid off before they convert to high interest

Q. I have an employer matched 401(k) and I am contributing the 6% required to get the match. I would like to save more. Should I put it in a 401(k) or Roth IRA?

A. If you plan to save an additional $5,500 or more per year, you will be limited by the Roth IRA. In that case, contribute more to the 401(k) so that you can get more of the money into a one way tax shelter. Then in years of very low income or low taxes, convert portions of that 401(k) to Roth IRA so the rest could grow tax free.

Q. It feels weird to me to have a lot of credit cards open, but you also mentioned it’s important to have a long credit history to have a high credit score. What do I do about my credit cards with annual fees?

A. As an easy rule of thumb, credit card companies make about 3% of how much you charge on the card, not counting fees and interest. If you charge more than what the annual fee is worth, you are in a good position to negotiate. In addition, if you play the points and miles game, some cards (such as the Chase Sapphire Reserve) might be a really good deal for travelers. Know how much the card and its benefits are valued to you, and those benefits need to outweight the cost of the annual fee. This isn’t hard math, it’s just a little bit of algebra and making reasonable assumpitons.

Then once you know your own numbers, call in and threaten to cancel the credit card, usually on your anniversary month when your annual fee is charged. You will be sent to the cancellation specialist. They are incentivized to keep you as a customer, so they may waive the annual fee (especially if you charge a lot) or give you more points. If neither happens, almost all credit cards with fees have a no-fee version. Ask to downgrade your card the no fee version and keep the credit history. This is especially important if this is one of your oldest cards. Then throw a small amount (I put my Hulu subscription on my oldest card, for example) on the card to keep a history on it going forward.

Q. My employer offers a 401(k) but I don’t trust that they actually contribute to it with the amount I want to set aside. Should I still contribute to my 401(k)?

A. That is super shady! If you are in such a situation, track your pay stubs and make sure you are getting paid correctly. If not, you have grounds to sue. Second, look into opening your own IRA or Roth IRA account with any third party provider (I like Fidelity). Third, find a new employer. Your career is worth so much, don’t throw it away on someone who doesn’t value you and is willing to break the law to profit.

Q. I read somewhere that your housing costs should not be more than 30-40% of your income, but that is so hard in NYC! What should I do?

A. This rule of thumb so to speak came from the mortgage underwriting industry as a way to make sure that people in general could afford their mortgage. I understand this is hard in NYC. Let’s think of it this way. Your rent / housing costs are the best place to save when you are young and healthy. Think back to your college dorm – which I hope wasn’t one of those super fancy new ones. Did it really kill you to have so little stuff? You survived, right? You can still do this, while you are young, and the habits you build today, will keep for a lifetime.

Let’s say you earn $75,000 gross income today, and you are able to save 20% (not too shabby), which is $15,000 a year. Now, let’s say that for the next 2 years, you move a bit further away, you take longer to commute to work and see friends, you give up privacy and get roommates, just for 2 years, and you find an amazing rent deal where you save $500 a month / $12,000 over 2 years. You invest that $12,000 in an index fund, and it grows 7% a year (adjusted for inflation) for the next 40 years. Those 2 years of sacrifice right now, will get you almost $180,000 in 40 years.

If you did not do the above, how much longer would it take you to save an extra $180,000? Without investing, assuming no income growth and no change in your spending, you would have to work an extra 15 years. This is why saving on rent – no matter what the “rules” say – is so meaningful. This is why you have to learn to be a little uncomfortable when you are young.

Here’s bit from my personal life. For the first 2 years of my marriage, my husband and I lived in a rent stabilized apartment (that we found through a friend), where our rent expenses came to less than 15% of our combined incomes. For those 2 years it wasn’t comfortable. We didn’t have laundry in the building which meant that Sunday mornings were dedicated to laundry. We lived 4 flights up and it was tiring for me to carry groceries and things up and down the stairs. At that time I disliked the experience, but you ask me now, just a few years later, if it was worth it, and I say yes. And if I had to do it again, I would, as long as my body is capable of it.

So do whatever you have to do – research, ask friends, ask around, to find cheaper rent. One caveat for women is that it is better to find it in a relatively safe neighborhood, or at the very least, in a neighborhood with a lot of people on the street. It is the #1 change you can make in your young lives.

==== The end! ====

For those who are curious about my personal finance presentations – I do these whenever there is an opportunity for me to present to young women. If you are part of an organization that would like to empower its members with better knowledge of personal finance, please reach out to me at info@savemycents.com to schedule me as a speaker. As Save My Cents is my passion project, I currently do not charge for this.

Now onto the winner… Congratulations to Ashleigh C. for winning the Save My Cents free personalized finance session, worth $150 (and probably 6 figures of your life savings if you follow my advice :D) Email me at info@savemycents.com to schedule your session!

If you are not part of my Facebook group, ask to join now to get daily inspiration for how to save more money and grow your net worth.